Investors are generally advised against looking at past performance, but data from the past seven elections suggests they should be strongly supporting Donald Trump. The stock market rose by an average 15.3 percent in the 12-months following a Republican win versus 7.6 percent for a Democrat victory. However, analysis of equity valuations and economic health going into previous elections reveals that these factors may be more important in determining stock market performance than who is elected to office.

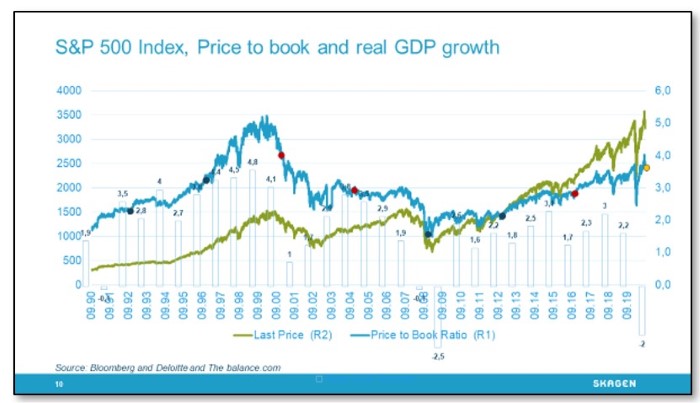

Democrat victories over the past three decades (blue dots) coincided with modest valuations (Clinton in 1992; Obama in 2008 and 2012) but economic growth often being very high (1992, 1996). Each was followed by a period of multiple expansion and steady equity market gains. Conversely, Republican wins (red dots) occurred against a backdrop of sky-high valuations in 2000 when Bush was elected (and the economy subsequently tanked) or above-average multiples but sluggish economic growth when Trump came to power in 2016.

While today's market is highly valued, this masks record polarisation between stocks and the average multiple is skewed by a handful of large and expensive technology companies. Investing outside of the 'FAANGM's, which together make up around a quarter of the US market capitalisation with a weighted P/B of 16.5x[1], should give the best prospects for valuation expansion, although the economic outlook is lacklustre and remains clouded by the COVID-19 pandemic.

Policy promises

Since the stock market values companies based on their earnings, policies that influence corporate profitability also matter. Using monetary policy to cut interest rates through quantitative easing, for example, will typically boost company profits and their stock prices should follow. More so for growth companies, whose fast-growing future earnings become more valuable today. Fiscal policy is also important, with tax cuts boosting corporate bottom-lines and government spending increasing demand overall but particularly in industrial, material and construction sectors where job creation would, in turn, boost consumption.

Biden has stated that he would roll back some of the corporate tax cuts made by Trump and increase fiscal spending. Trump has not been explicit, but from what we know of his first term, he will do whatever the stock market needs to grind higher.

In the first year after Clinton and Obama were elected the materials, industrial and consumer discretionary sectors outperformed the S&P 500 while healthcare and consumer staples underperformed. This could be indicative for the relative winners and losers following a Biden victory.

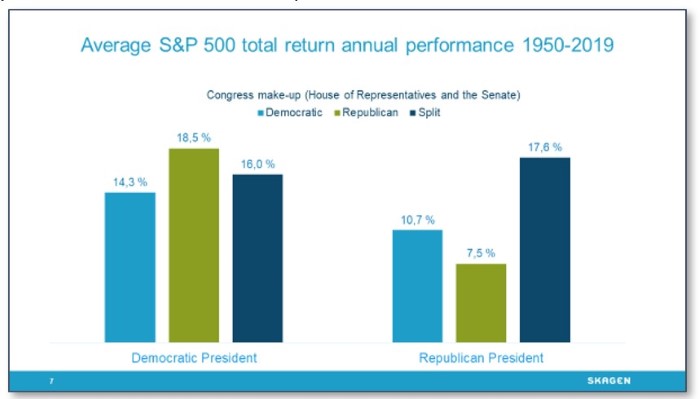

Investors are also concerned with the government's ability to enact policy through Congress. The following chart shows the composition of the House of Representatives and Senate under previous Democratic and Republican administrations.

Historic returns suggest that the worst outcome for stock markets would be if Trump wins the election and the Republicans win a majority in Congress while the best equity returns have previously ocurred under a Democrat administration with Republicans controlling Congress. A split Congress would risk gridlock, however, bringing me to the last point.

Fearing the unknown

The market does not like uncertainty. Never has the temperature and partisanship been so high prior to an election, leading to febrile confrontations on key issues:

1. Racism, violence and gun control

The mobile revolution has brought dire images and proof of systemic racism into our living rooms, making it much harder to deny. The mass shootings in El Paso and Michigan last year also sparked new debate into the right to own and wear weapons.

2. Inequality and the cost of healthcare

10 percent of the wealthiest Americans own 87 percent of the stock market while access to well-paid jobs and the costs of healthcare are ongoing inequalities for many Americans which have only been accentuated by the COVID-19 pandemic.

3. Climate change

The US withdrawal from the Paris Agreement and deregulation of environmental legislation has coincided with a growing number of hurricanes and terrifying wildfires.

4. Supreme Court justices

Supreme Court justices serve for life and Ruth Bader Ginsberg's death has sparked controversy over the nomination of a new justice as the Supreme Court could remain split politically or move in a distinctly more conservative direction.

Whichever candidate has the most credibility to handle these issues for the longer-term will provide more certainty for the long-term health of the stock market.

What do investors think will happen?

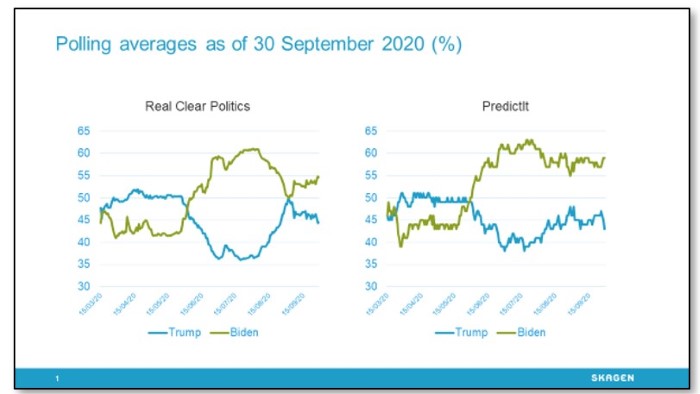

According to the latest polls, Biden is in the lead and the Senate looks to be even. If the Senate remains Republican, many market participants fear that the resulting gridlock in Congress could stall the nascent recovery. According to a Hartford Funds survey of nearly 1,000 investors conducted last month, 46 percent said a Republican-controlled White House and Senate would be the best outcome for markets. The rally since March despite Biden leading the polls, however, suggests the broader market may think differently.

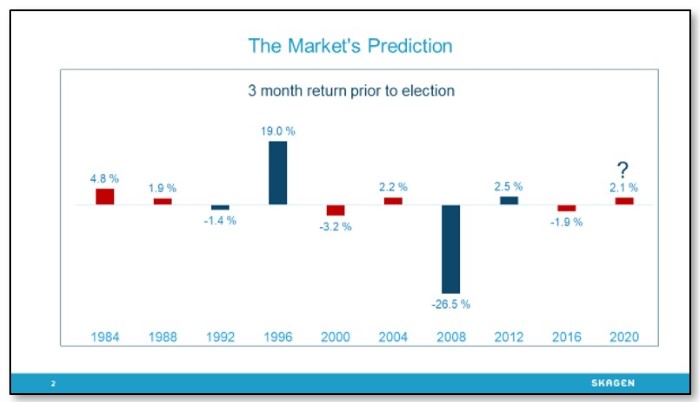

Bloomberg analysis of the last seven elections reveals that every three-month period with positive returns prior to polling day resulted in a win for the incumbent. As of 30 September this would have indicated a win for Trump but with US markets expected to react negatively to news of the President's positive COVID test, the picture may look very different by polling day.

Meanwhile, the polling averages from the Real Clear Politics website show nail-biting fluctuations over recent months:

To conclude, although the historical data does not give a clear answer to our question of which candidate would most benefit equity investors, it reminds us that the stock market usually finds a way to grind higher whoever wins. With two out of three years ending higher on average since 1926, the S&P 500 index has returned just over 10 percent per year, and positive for both Democratic and Republican presidents alike, with Republicans enjoying twice as high returns on average. While a double-digit increase may be challenging in this low interest rate environment, I would not bet against the market continuing its impartial rise.

At SKAGEN, our focus will remain on companies. We will closely monitor the US political landscape but try to separate election noise from tangible impacts on our portfolio holdings. Heightened volatility may also present short-term opportunities, but I am confident our long-term approach of selecting strong but undervalued companies will continue to maximise client returns over different economic and political cycles.

References

[1] Source: Bloomberg, FAANGM: Facebook, Amazon, Apple, Netflix, Google (Alphabet), Microsoft