My previous article examined the valuation gap and the challenge facing investors; should we continue to choose growth even if the maths implies unobtainable expansion to justify the current price, or should we instead select value which has been a one-way street to underperformance for the last few years? It concluded that the latter is potentially a generational opportunity.

What is investing if not value investing?

If the true value of a stock is purely the sum of discounted future cash flows, isn't all investing an effort to create value by buying an asset priced below its intrinsic worth? It might be that "value" investors are more risk averse and sceptical that growth will subside earlier while "growth" investors are more optimistic and believe future growth will be stronger for longer. Both are ultimately aiming for the same goal of buying an undervalued asset.

A fundamental characteristic of the last decade has been falling interest rates around the globe, which has lowered the weighted average cost of capital (WACC) and resulted in projected future cashflows being worth more today. An increasingly lower cost of borrowing has been an enormous tailwind for stocks that can't be ignored.

Forecasting additional future cashflows is highly sensitive to the cost of capital you apply. An illustrative example is a company for which analysts expect an additional USD 1 billion in cashflow in 10 years. At a cost of capital of seven percent, the extra USD 1 billion is worth 39 percent more today than if the cost of capital was 10 percent.

This goes some way to explaining the rationale of today's market where the current recession has decimated interest rates to around zero. It goes without saying that this sensitivity goes both ways.

Big tech, bigger risks?

We have reached a point where the combined USD 6.8 trillion valuation of the world's best-known growth stocks (Facebook, Apple, Microsoft, Amazon and Google) exceeds the market capitalisation of all French, German, UK, Spanish and Italian listed companies[1]. The tech giants account for 20 percent of the S&P 500 and 12.5 percent of the MSCI World index.

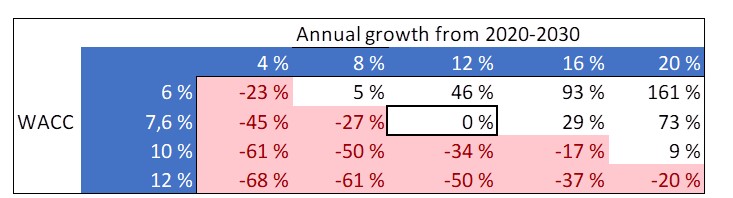

The combined free cashflows (operating cash flow minus capex) expected of these companies according to Bloomberg is USD 171 billion this year and forecast to grow to USD 206 billion in 2021, implying a free cashflow yield (FCFY) of 3.0 percent. Low, but perhaps not excessively so in our low interest rate environment. And their current share prices are fair if we believe free cashflow will grow by 12 percent per year over the next decade at the group's current cost of capital of 7.6 percent[2].

These assumptions and valuation do not look outrageous on the surface. However, a more sceptical and risk-averse investor who digs deeper would see how sensitive they are and consider what could go wrong?

- Interest rates increase during the next ten years, driving the cost of capital upwards

- Competition increases but anti-trust laws remove the possibility of neutralising rivals through acquisitions, thereby lowering the projected growth profile

- Tax authorities will be tempted to get their hands on more of the profit stream. Given the total expected federal income from corporate earnings next year in the US is projected at USD 283 billion[3], this is not an outlandish risk considering the democrats are leading the presidential 2020 race

We can test our assumptions in the following table that shows the up or downside to today's share price by increasing or decreasing expectations for annual growth in cashflows (horizontal) or the cost of capital (vertical).

As a reminder that things can change quickly, the average WACC for these companies was 11.2 percent back in 2018, compared to 7.6 percent today[4]. I will let you judge whether investors are merely playing the bigger fool's theory or not.

Maybe the difference between a growth investor and a value investor is similar to comparing an optimist and a pessimist; one is blinkered to anything going wrong and the other sees risks around every corner. Until now the optimist has enjoyed an extended period in the sun. When the tide turns and the music stops, however, we will see who is swimming naked.

[1] Source: Bloomberg, using FTSE All Share (UK), DAX 30 (Germany), CAC 40 (France), FTSEMIB (Italy) and MADX (Spain) indices as of 1 August 2020

[2] Source: Bloomberg

[3] Source: The Office of Management and Budget

[4] Source: Bloomberg