The content on this page is marketing communication

About us

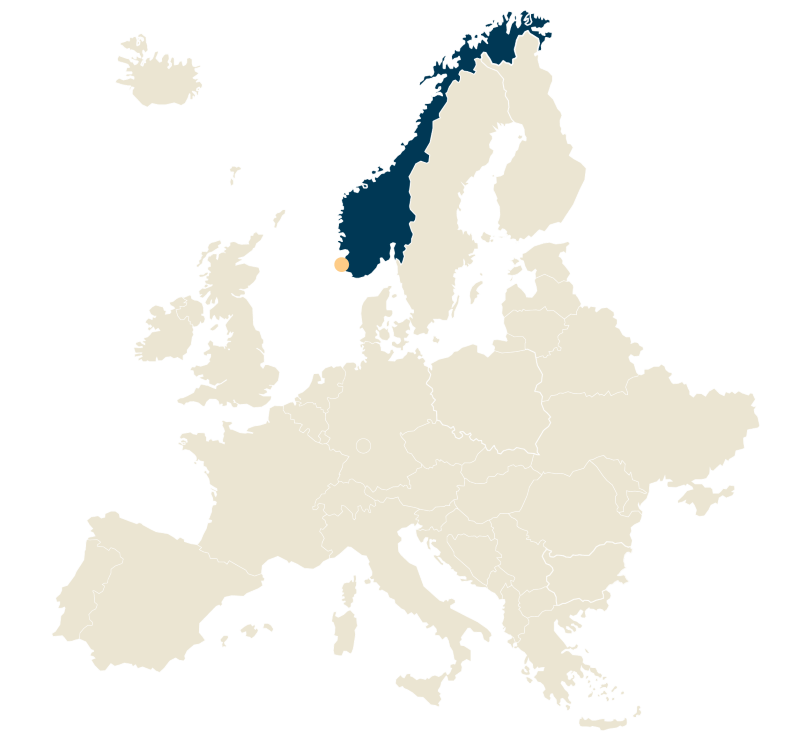

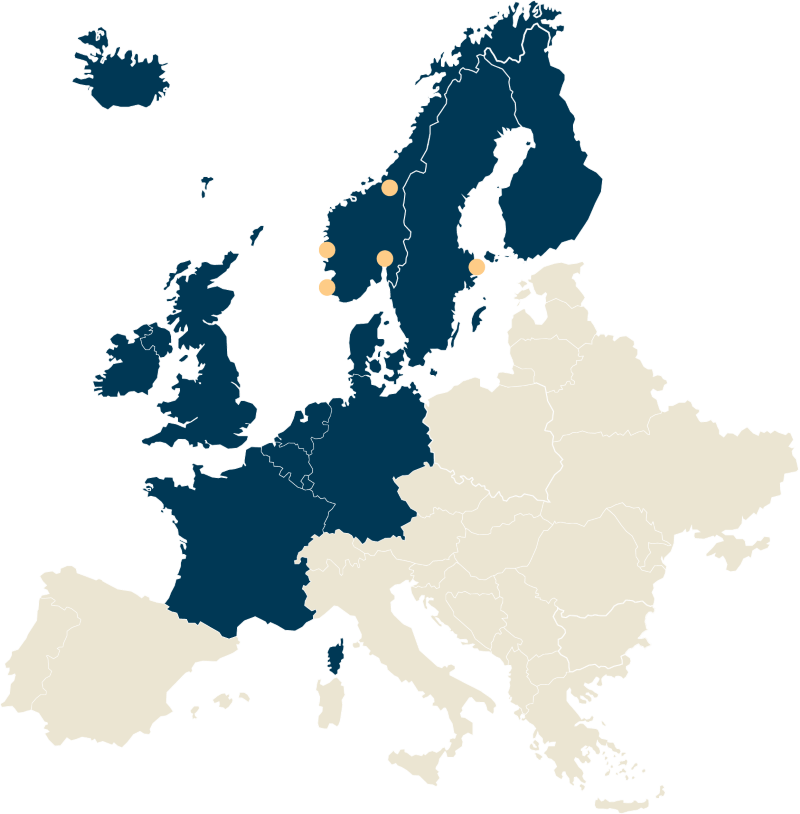

Established in 1993, SKAGEN has a long track-record of delivering alpha for international investors through a range of equity strategies guided by our active value-oriented investment philosophy.

Contrarian approach, independent thinking

We have managed highly active, value-based equity and fixed income funds on behalf of clients for over 30 years. SKAGEN is part of Storebrand Asset Management but operates as an independent boutique with its own Board. Our funds are administered by Storebrand but managed by SKAGEN's investment team.

We are stock pickers who do all our own company research and analysis. We think long-term and are unafraid to invest in unpopular companies if it it is in the best interests of the funds' unitholders – when they do well, we do well.

Our objective is to provide the best possible risk-adjusted returns.

1993

Around 448 unit holders

Approx. EUR 2.4 million under management

2024

Around 90 000 unit holders

Approx. EUR 6.6 billion under management

Simple investment philosophy

Our investment philosophy is simple: to find investments that are mispriced by the market, but whose value is likely to be recognised in future, and which offer great potential for the risk taken.

SKAGEN has a single house philosophy that we have applied consistently since start.

We offer:

- Value focus

- Global mandates

- Active management

- Long-term focus