Central banks have remained hawkish, but the bond market is beginning to show signs that interest rates could be approaching peak levels. Emerging markets once again underperformed developed markets as China, in particular, underperformed on the back of disappointing COVID re-opening dynamics and continued geopolitical uncertainty.

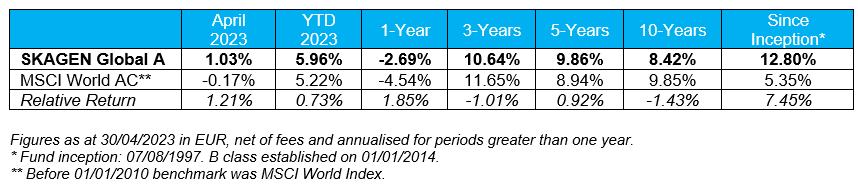

SKAGEN Global

Brown & Brown led absolute and relative gains as holdings reported good Q1 earnings. SKAGEN Global climbed 1.03% during the month, outperforming the MSCI All Country World Index which dropped 0.17%. Read the SKAGEN Global April 2023 report for more information.

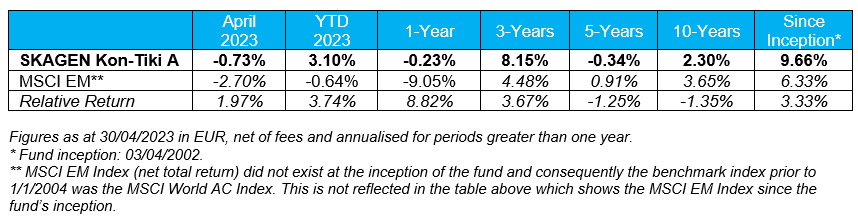

SKAGEN Kon-Tiki

Chinese holdings drove relative strength as Gedeon Richter rejoined the portfolio. SKAGEN Kon-Tiki was down 0.73% during the month, beating the MSCI Emerging Markets Index which was 2.70% lower. Read the SKAGEN Kon-Tiki April 2023 report for more information.

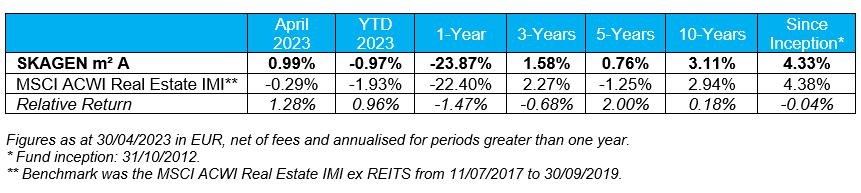

SKAGEN m2

Grainger led absolute and relative gains as European real estate recovery continued. SKAGEN m2 added 0.99% over the month, outperforming the MSCI All Country World Index Real Estate IMI benchmark which dropped 0.29%. Read the SKAGEN m² April 2023 report for more information.

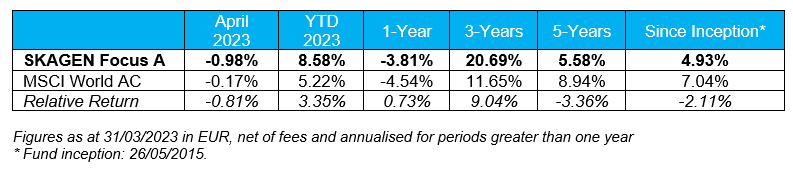

SKAGEN Focus

Canfor Pulp weakness offset Sao Martinho strength as Persimmon joined portfolio. SKAGEN Focus dipped 0.98% during the month, lagging the MSCI All Country World Index which fell 0.17%. Read the SKAGEN Focus April 2023 report for more information.