Lately, global regulators have belatedly begun to take aim at greenwashers. DWS received a dawn raid from German police and is currently under investigation by both European and US authorities while in the US, BNY Mellon was recently fined by the SEC for providing misleading information on its sustainable investments. Unsurprisingly and understandably, ESG ratings are firmly in the regulators' crosshairs.

The European Securities and Markets Authority (ESMA) in June found 59 ESG rating providers active in the EU as part of its information gathering on the market. It highlighted "a lack of coverage of a specific industry or a type of entity, insufficient granularity of data, and a lack of transparency around methodologies used by ESG rating providers" as the most common shortcomings identified by the users.

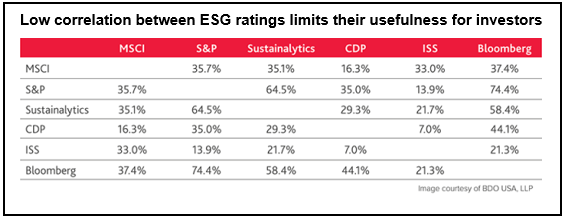

The different methodologies and measurement systems used can produce wide-ranging results and often contradictory recommendations. A recent CFA study of the six largest providers of ESG ratings for over 400 companies across 24 industries found weak correlation between scores with most below 50% and some as low as 7% (see table). By comparison, the three largest credit rating agencies had a correlation of between 94% and 96% for the same companies.

The picture varies across sectors. A 2019 study[1] found the largest seven ratings agencies disagreed most on telecoms and consumer durables, and least on business equipment and manufacturing, while in a recent article Michael Gobitschek highlights the real estate ratings riddle where around 600 different systems vie for attention. Agreement also differs significantly between ESG's three pillars. As climate and biodiversity assessment has become increasingly data-driven, there is greatest consensus on environmental scores (46% correlation), compared to social (33%) and governance (16%) factors, with the latter particularly weak in the finance sector (10%).

A case in point is Credit Suisse, which was convicted by Switzerland's Federal Criminal Court in June of failing to prevent money-laundering. Governance ratings for the Swiss bank varied considerably between providers at the start of the year, ranging from 15% (S&P Global) to 81% (Refinitiv), despite a number of high-profile scandals including executive sackings and $7 billon of losses from lending to failed hedge funds and supply chain financiers.

More questions than answers

While standardisation clearly goes against the commercial interests of ESG rating providers, the large inconsistencies between them at present is clearly a problem for investors. It creates confusion when evaluating different funds, particularly as transparency is almost non-existant without access to the underlying research. This risks being self-defeating in slowing the adoption of ESG among investors and companies.

More seriously, it can lead to unintended biases in portfolio construction, for example towards larger companies which have greater resources to provide ESG disclosure and are more likely to be covered by the dominant providers. Funds may also be skewed geographically with European-based companies found to have higher ESG ratings than those in other parts of the world[2]. It is also open to abuse by investment managers who can cherry-pick ratings to inflate the ESG credentials of their portfolios – greenwashing.

For these reasons, regulators are watching closely. ESMA recently announced "a possible assessment around the need for introducing regulatory safeguards for ESG rating products" in Europe. Across the Atlantic, the SEC is proposing greater scrutiny and standardisation of ESG disclosures in fund marketing.

We welcome this greater regulatory oversight, even if it is somewhat daunting. ESG remains subjective and lines of suspected foul play are increasingly blurred. These aspects have been top of mind in SKAGEN for a long time and we are frequently working with third parties to ensure that we manage those expectations. We believe in open communication on dilemmas and trade-offs; we try not to sugar coat and simplify what is a very complex set of issues.

In SKAGEN, we use rating agencies the same way as we use equity research – as one input to be considered among a number of quantitative and qualitative factors. Earlier this year, Portfolio Manager of SKAGEN Kon-Tiki Cathrine Gether wrote about a recent issue at UPL where we found factual errors in one provider's ESG assessment that fundamentally undermined their view of the company. Likewise, investors who are prepared and skilled to analyse smaller companies will find stocks that have no sustainability rating but are often doing a better job at managing ESG risks than their larger peers.

Just like company valuation and cash-flow analysis, there is no substitute for hard work and doing your own research. Investors prepared to go the extra mile, for example by engaging with companies and asking challenging questions, can similarly tilt the risk-reward balance in their favour.

References

[1] Source: ESG Rating Disagreement and Stock Returns, Swiss Finance Institute Research Paper, August 2019

[2] Source: Study on Sustainability-related ratings, data and research, European Commission, June 2021