In this article, we discuss:

- Why instability has returned to equity markets and what this means for investors

- Our approach to volatility and how we manage our funds to minimise its impact on our portfolios

- Why market turbulence may continue and how investors can use it to maximise long-term returns

Investors recently celebrated the ninth anniversary of the end of the last bear market. Despite a few bumps along the way from the fallout of the financial crisis, the recovery of global equities since the depths of 2009 has produced impressive gains in excess of 250%(1). Following two years of relative calm, however, the first quarter of 2018 offered investors a reminder of the risks lurking below the surface of what is now the second longest bull market in history.

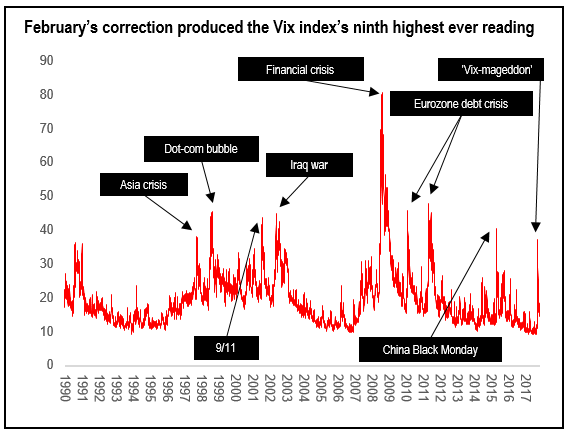

After delivering solid returns of 8.8% last year and 11.1% in 2016, global equities fell 4.8% in EUR during the first three months of 2018(2), a period of turbulence which saw US stocks suffer one of the fastest 10 percent corrections in history and their second worst week since 2011. Sparked by rising bond yields, the market instability was exacerbated by trading in volatility itself as a number of investment products linked to the Vix Index – or 'fear gauge' – imploded.

Calm before the storm

These instruments had been designed to allow traders to profit from market tranquillity. Following a couple of minor tremors in 2016 around the UK referendum and US election, 2017 was remarkably a year of record lows for the Vix, despite the political chaos around Brexit and huge volatility in the White House. The peace abruptly ended in February over fears that rising wage pressure and inflation could force the Federal Reserve to raise interest rates higher than expected and volatility-exposed investors were panicked into buying further derivatives to minimise losses. The Vix reached 37 – far below its record of 80 during the global financial crisis – but a one-day spike of 115% was its largest ever and proved terminal for several inverse volatility products and costly for their investors.

Portfolio protection

Identifying the specific causes of market volatility can be tricky, particularly when complex fundamental and technical forces are at work. It is therefore impossible to predict with any degree of certainty. However, it is important to monitor and, as with any other threat, minimise its impact on our funds where possible through prudent risk management.

SKAGEN's investment process ensures that our portfolios are diversified across different sectors and countries to avoid being overly exposed to a particular area. When the Dow Jones Industrial Average tumbled to its largest ever one-day absolute loss in February, wiping out all of 2018's gains in the process, it was the energy, financial services and healthcare sectors that fell the furthest. Similarly, although most countries suffered losses, emerging markets generally underperformed with Asia being hit particularly hard.

Our portfolios are constructed bottom-up and while geographic and sector risks exist for every company, it is important to consider these in aggregate to reduce the portfolio impact of county or industry-specific events, such as war or regulatory change. For example, we target that no individual sector exceeds 25% of any portfolio. SKAGEN Focus goes a step further by applying a fundamental risk monitoring system to avoid the portfolio being overly exposed to systematic factors such as the yield curve or oil price.

Although monitoring aggregate exposure to particular areas or theme is instructive for understanding portfolio risk, in an increasingly interconnected world where markets often move in synch, it is arguably less useful as a risk management tool. Ultimately, we believe the safest protection comes from investing in reasonably valued companies where the share price provides a cushion against downside risk and market volatility. Value stocks have historically tended to outperform growth in high-volatility markets as investors seek comfort in what are perceived to be safer companies. All of our equity funds are currently valued at a significant discount to their respective benchmarks and those with a global mandate are underweight the US as stock selection has led us away from what appears to be an expensive market, relative to both historic averages and other regions.

In addition to attractive valuations, we also look for balance sheet strength and typically invest in businesses with low levels of debt in order to reduce financial risk. For example, nearly a quarter (24.5%) of SKAGEN Global's holdings by portfolio weight have a net cash position while less than ten percent have a net debt to EBITDA ratio above three. The more debt a company has, the more volatile its share price tends to be in relation to market movements, and this is likely to be magnified in the current environment of increasing corporate leverage and investor concerns about rising interest rates.

The recent spike in volatility coincided with year-end financial reporting for most companies, and those across our portfolios are generally performing well with many delivering growth in revenues and profitability. Given this strong underlying performance, our portfolio managers used the market instability to strengthen the funds by increasing positions in companies whose share prices fell despite no fundamental deterioration in their investment case. For example, SKAGEN Kon-Tiki added to its holding in HollySys, the Chinese industrial and rail automation systems provider, while SKAGEN Focus topped up its investment in Teikoku Sen, the Japanese disaster prevention business. Meanwhile SKAGEN Global used the market weakness to initiate positions in Nissan Chemical Industries, Shangri-La and Adobe.

Choppy waters ahead?

In previous instances when the VIX has risen above 30, such as in 1987, 1998, 2008, 2010 and 2015, it has tended to remain elevated for several months. The rise of volatility-related products and their role in fuelling the underlying trend they were designed to track could also mean that future spikes could become more frequent and pronounced than before.

Other factors suggest that investors could be heading for further stock market instability. Growing friction between the West and Russia means that geopolitical risks remain high despite the thawing of tensions with North Korea. Companies also face the threat of greater protectionism, while the outlook for some emerging markets is further clouded by uncertainty over US monetary policy. With valuations at or close to record levels across many stock markets, investors are understandably nervous and it may not take much to spark another round of volatility.

Against this backdrop, we believe that our clients' interests will be best served through our proven approach of selective exposure to strong companies whose valuation offers a margin of safety and the potential for growth. It is similarly important that investors retain a long-term horizon to maximise gains and this patience is often doubly rewarded during volatile times when bargains can be added to further strengthen portfolios. By sticking to this philosophy, and holding our nerve through the market gyrations, we can skew the risk-reward balance even more in our favour to deliver superior returns.

(1) MSCI All Country World Index, 9 March 2009 – 31 March 2018 in EUR, net of fees (+251.0% or 14.8% annualised)

(2) MSCI All Country World Index in EUR, net of fees (calendar year 2016 & 2017, 2018 YTD as at 31 March (-4.8%)

IMPORTANT INFORMATION

Except otherwise stated, the source of all portfolio information is SKAGEN AS as at 31 March 2018. Data has been obtained from sources which we deem reliable but whose accuracy is not guaranteed by SKAGEN.

Statements reflect the writer's viewpoint at a given time, and this viewpoint may be changed without notice. This article should not be perceived as an offer or recommendation to buy or sell financial instruments. SKAGEN AS does not assume responsibility for direct or indirect loss or expenses incurred through use or understanding of this article. Employees of SKAGEN AS may be owners of securities issued by companies that are either referred to in this article or are part of a fund's portfolio.