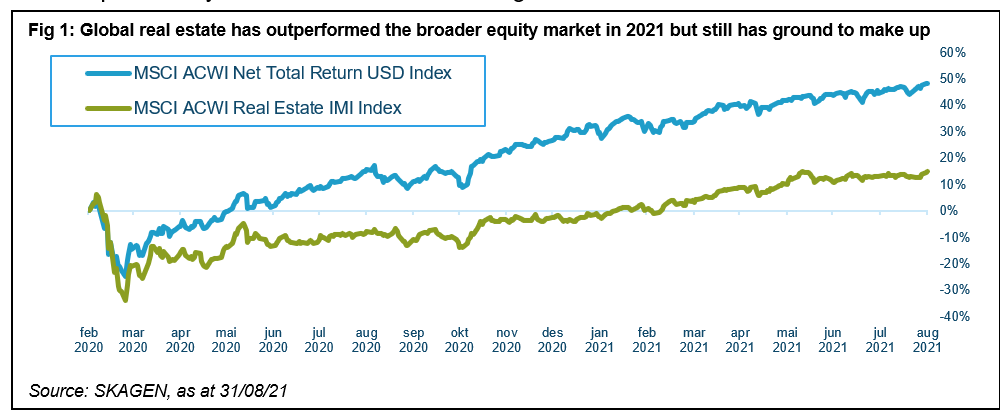

As stock markets around the world become ever more expensive – the S&P 500 recorded a new all-time-high in September – real estate is looking increasingly attractive. While global equities recovered their March 2020 COVID losses in a rapid three months, it took listed property until February to clear the same hurdle following a year when it underperformed the broader stock market by over 22%[1].

So far 2021 has been a story of recovery. Global real estate (+19.4%) has outperformed equities (+16.2%) with China (-9.7%) the only major country in the red. All sub-sectors have posted gains with Industrial (+30.1%) building on its positive 2021 performance, while Retail (+26.1%) and Office (+14.0%) have almost recouped their 2020 losses. Hotels (+12.4%) remain below pre-pandemic levels but should quicken their recovery as travel and tourism returns, particularly when transatlantic visits begin in November[2].

Opportunities from market transformation

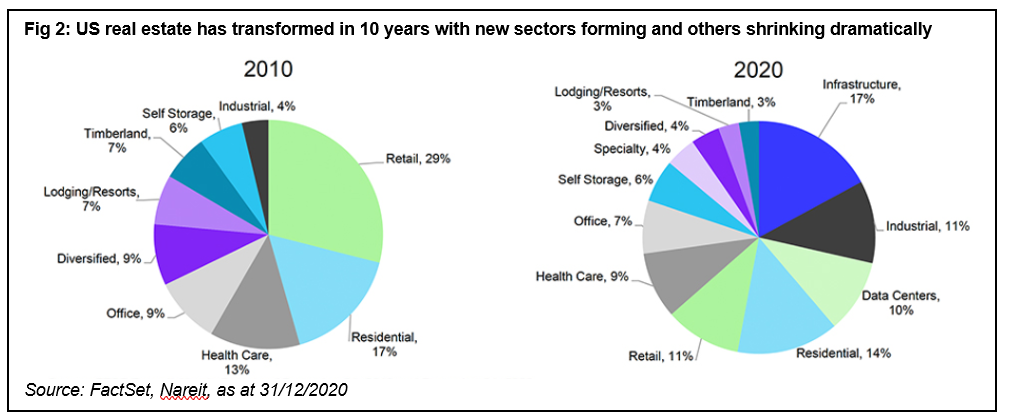

While stock markets look expensive on almost every historical metric, real estate is valued only slightly above its historic average at a modest 4% premium to net asset value (NAV), but this masks huge differences between segments and countries[3]. Property is one of the most dynamic markets in the world with new sub-sectors appearing and geographic anomalies providing opportunities for investors. Over the past decade the largest US market has transformed, notably traditional Retail has shrunk while Infrastructure and Data Centres have emerged from nowhere to now represent nearly 30% of assets.

This reflects changing consumer behaviour and offers investors greater diversification with alternative sectors now making up over half (57%) of the US market[4]. It also provides a pointer to trends overseas where property development tends to lag the US – this is particularly valuable for active investors like SKAGEN m² with a global mandate to be able to identify opportunities before valuations increase.

We have recently found opportunities in the Office segment where valuations remain attractive despite share prices recovering, particularly for companies providing sustainability-focused solutions. A recent Knight Frank study found that London office buildings with a BREEAM sustainability rating of 'Outstanding' achieved rent premiums of up to 12.3% while those rated 'Excellent' commanded +4.7%[5]. SKAGEN m² has added Great Portland, Paramount Group and Icade this year which should all benefit as office working increases in one form or another following the pandemic.

We have also invested in some interesting companies within the Diversified sub-sector which has historically traded at a discount due to a lack of singular focus. For example, Tokyu Fudosan Holding is a Japanese property conglomerate with attractive lodging and office assets as well as a renewable energy portfolio which trades at a large discount to NAV.

Diversified portfolio

SKAGEN m2's portfolio is roughly split 2/3 in resilient and defensive segments (Data Centres, Logistics, Self-storage, Rental Residential, Health Care) and 1/3 in recovery sub-sectors (Office, Retail, Hospitality, Diversified). The fund also has good size diversification across small (35%), mid (39%) and large (26%) cap stocks. Smaller companies also provide exposure to M&A opportunities which are usually positive for unitholder returns; five SKAGEN m2 holdings have been involved in consolidation so far this year.

Around a quarter (24%) of the fund's assets are invested in US holdings; its largest country exposure but significantly below the index weighting (57%). The S&P 500's strength has also boosted US REITS which are up 29% this year and the US has become increasingly expensive relative to European markets[6]. Despite our US underweight being a headwind for relative performance, SKAGEN m2 remains in step with its benchmark year-to-date with successful stock picking driving strong returns for unitholders.

Inflation protection

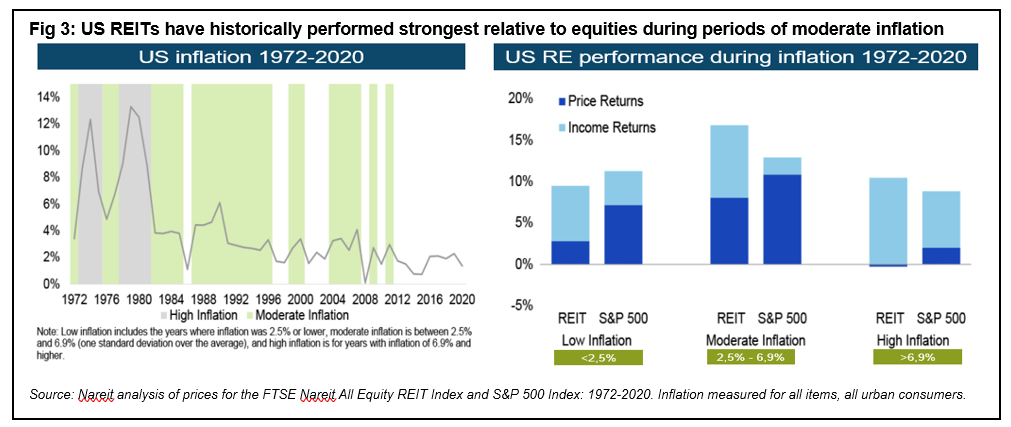

Rising inflation is also likely to provide a tailwind for real estate. Property has historically been a good hedge against rising prices as leases tend to be inflation-linked and asset values are supported as the supply of new buildings contracts when the costs of labour and raw materials increase. US inflation is currently running around 5.3%, a level which has historically coincided with REITs outperforming the broader equity market in total return terms.

In conclusion, we believe that macro conditions for the real estate asset class are positive with its three key drivers – supply, demand and credit – all increasingly supportive for most parts of the world and segments. The economic cycle is similarly favourable as property assets tend to outperform in the early expansion phase and inflationary environments we are currently experiencing.

Fundamentals are also positive with property companies generating strong cash flow and earnings growth while highly dispersed valuations provide opportunities for stock pickers like SKAGEN m². The ingredients are in place for continued strong returns from a sector undergoing an exciting long-term transformation and one reborn since the COVID pandemic.

NB: All figures as at 31/08/21 unless stated

Footnotes

[1] Source: MSCI. MSCI ACWI IMI Real Estate Index (USD) -5.7% vs. MSCI ACWI Index (USD) +16.8%

[2] Source index data: MSCI. MSCI ACWI IMI Real Estate Index vs. MSCI ACWI Index. Source country and sector data: Datastream, UBS. All as at 31/08/21 in USD.

[3] Source: Worldscopt, IBES, Datastream, UBS estimates as of 31/08/21

[4] Source: FTSE Nareit, as at 30/06/21.

[5] Source: Knight Frank, The Sustainability Series, September 2021

[6] Bloomberg US Reits, as at 31/08/21 in USD.