It appears as though the party is not yet over in the global real estate market. Low interest rates, solid balance sheets and transparent cash flow/earnings due to leasing contracts and known credit levels all make for a favourable environment. Real estate – and commercial real estate in particular – is generally closely aligned with GDP growth, and this is sizable in some areas. Finally, we are also seeing demand driven pressure on rents in many markets at present.

Below we take a closer look at the current trends and developments we are currently seeing in the global real estate market.

Predictable leasing contracts and credit sources

There is currently a high degree of foreseeability in leasing contracts. In many cases market rents are well above the current rent roll. Two holdings in the portfolio of the real estate equity fund SKAGEN m2 are good examples of this; Deutsche Wohnen has current rents that are 32% below market rents, while 50% of the rent roll of Spanish Colonial will be revised over the next two years to levels well above the current rent. Some of the growth is already priced into companies, but we expect more to come in many cases, driven by structurally under-supplied markets, such as rental apartments in Stockholm and Berlin, and higher than expected demand, such as for large Grade A buildings in Madrid with A location commercial assets.

Credit sources and levels are also predictable at present. Over the past few years, companies have put a great deal of effort into refinancing credit at a very low level; in some cases it is fixed at this level for a long time to come. There are currently no signs of tighter credit markets as long as companies have solid balance sheets and cash flow. We believe that high balance sheet awareness is key; memories of the financial crisis are deeply etched in many management teams' minds and companies in general are much more solid today than they were at that time.

Strong earnings and cash flow

The earnings and cash flow momentum in real estate is strong and this is expected to last well into next year. Over the next two years, however, we believe that earnings and cash flow will grow slightly more moderately than we have seen this year, based on growth, trends and low interest rates. Capital values will certainly increase next year but may subsequently flatten out, depending on interest rates, leasing levels and demand.

Alignment with GDP growth

GDP growth is closely aligned with commercial real estate and the International Monetary Fund (IMF) recently upgraded global growth expectations to 3.7% for 2018. Low unemployment rates are also beneficial to real estate consumption and as such, it is interesting to note that US and Japanese unemployment rates are at their lowest levels in 17 and 23 years respectively. Nonetheless, these indicators may also lead to a tightening of interest rate policies.

Interest rates key

Whether or not interest rates will be tightened is the million dollar question. If they are hiked as expected, however, and at a slow rate due to inflation expectations, we do not have too much to fear. Inflation expectations are compensated for in the leases, and are a sign of good economic development. This is generally something that is beneficial for real estate demand. If real interest rate ticks upwards, however, it is harder to compensate for. SKAGEN m2 has positioned the fund to have an additional growth component to mitigate some of the risk of higher interest rates. If the rate of return increases, it may lead to lower capital values, which will to some extent be compensated for by higher revenue discounted back.

Some countries are actually loosening their interest policies, such India, Brazil and Iceland. Our assessment at present is that rates will be lower for longer rather than the reverse, and we will have to monitor any potential bubbles that may arise locally. SKAGEN m2's strategy is to invest in companies with growth prospects above organic rental growth but with huge revision potential from current rent to market rent. This means that additional topline growth will compensate for some of the value loss from yield expansion (higher required rate of return).

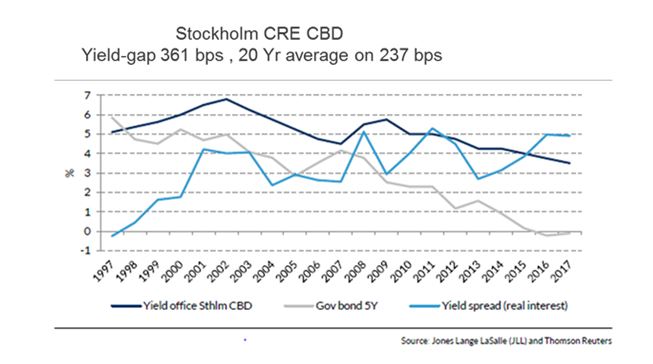

Record yield spreads

Yield spreads are currently record wide. In the Stockholm central business district (CBD) for example, the spread is 360 basis points, while it has historically been about 240 basis points over the past 20 years. This means that either the interest rates should go up or assets are getting more expensive. We believe that rates will move up but there is also some capital value gain. This record spread pattern is seen in a number of places and segments (see graph).

Increasing M&A

The trend of increasing merger and acquisition and transaction activity is one that we believe will continue and intensify given the spread between listed and unlisted assets, where listed assets are trading at a discount. Large pension players with long time horizons are buying trophy assets in big cities at very low yields. This in turn pushes up prices and yields for all real estate in the same markets.

In addition, superfunds such as Blackstone and Brookfield are raising record funds. Good examples of this are the Blackstone acquisition of the SKAGEN m2 holding Sponda in June this year and their attempted acquisition of another of our holdings, D.Carnegie. There is a lot of money on the side lines moving up to the next risk level after bonds, namely real estate. It is immaterial whether the money flows into listed or unlisted real estate; eventually the pricing of the asset will be the same based on transaction multiples and cash flows.

We have also noticed more Asian money flowing into Europe and the US following liberalisation, in spite of the foreign investment restrictions imposed by the Chinese government this spring.

Looking ahead, we expect more consolidation in the industry, which is natural at this stage in the cycle when it is harder to obtain growth and extract synergies. There is a lot of scale in rental apartments, for example, but also in logistics. Some good examples are the purchase of Blackstone's Logicore by the Chinese sovereign wealth fund, which is estimated to be the biggest IPO in Europe this year for EUR 13.8bn, and the SKAGEN m2 holding GLP that is pending a bid from Chinese consortium, Nesta.

Trends

Over the next few years, real estate will be influenced – both positively and negatively – by a number of trends. Demographic trends such as population growth, urbanisation, increasing wealth, aging population, etc. all have positive implications for real estate. Another strong trend is consumption disruption due to increasing e-commerce. This is negatively affecting shopping malls in some markets and segments, but is very beneficial for automation and logistics and SKAGEN m2 been actively positioning itself to take advantage of the latter. Although it is difficult to earn money on trends in the short term, it is important to maintain a good overview of developments since real estate is cyclical and the cycles tend to follow the trends.

Opportunities in uncertainty

There are pockets of growth and opportunities to be found in most scenarios. One of SKAGEN m2's best performing stocks in 2017, for example, is the Italian company, Beni Stabili, which we bought during a period of uncertainty last year in the days prior to the Italian referendum. Other areas where we might look going forward include London when there is more visibility regarding the Brexit outcome or Frankfurt, where many companies are now moving.

Attractive valuation levels

Valuation is still attractive in many parts of the world from both a cash flow perspective but also on substance. Nonetheless, SKAGEN m2 continues to focus on the companies and finding undervalued or mispriced stocks.

There will be increasing activity when it comes to capital allocation, i.e. share buy backs and higher dividends, as the price of assets are starting to get high in places and cash flow is strong. There are examples of companies in the SKAGEN m2 portfolio that have started to crystallise values by selling assets at a premium and buying back shares at a discount. This is activity we look for and will increase in future.

Historically correlation with the overall stock market has been high in the short term but less so over time. This is explained by the unique characteristics to be found in the real estate asset class, although a certain amount of volatility must be reckoned on.

Picking the best globally

SKAGEN m2 has a global mandate and is therefore able to take part in worldwide economic growth at the same time as ensuring diversification when it comes to currency, region and categorisation of property or segment. This ensures transparency and liquidity in our investments and improves the risk/return profile of our portfolio. We are able to benefit from local management teams' know how and their network in their home markets. Importantly, this enables us to move from fair valued to undervalued markets, cities and companies as situations develop. We are therefore well positioned to take advantage of the opportunities and trends that we see developing in the global real estate market over the next few years, while mitigating potential risks.

IMPORTANT INFORMATION

Except otherwise stated, the source of all portfolio information is SKAGEN AS as at 31 November 2017. Data has been obtained from sources which we deem reliable but whose accuracy is not guaranteed by SKAGEN.

Statements reflect the writer's viewpoint at a given time, and this viewpoint may be changed without notice. This article should not be perceived as an offer or recommendation to buy or sell financial instruments. SKAGEN AS does not assume responsibility for direct or indirect loss or expenses incurred through use or understanding of this article. Employees of SKAGEN AS may be owners of securities issued by companies that are either referred to in this article or are part of a fund's portfolio.