The darkening economic clouds have pushed global listed real estate markets down by 20% year-to-date[1]. As usual, behind the headline drop are large regional differences with Asia (-5%) and the US (-12%) faring better, while European (-39%) and Nordic (-54%) markets have fallen much further. Despite its overweight exposure to these underperforming regions, SKAGEN m2 (-21%) is broadly in-line with the benchmark, largely due to good stock picking.

Eye of the storm

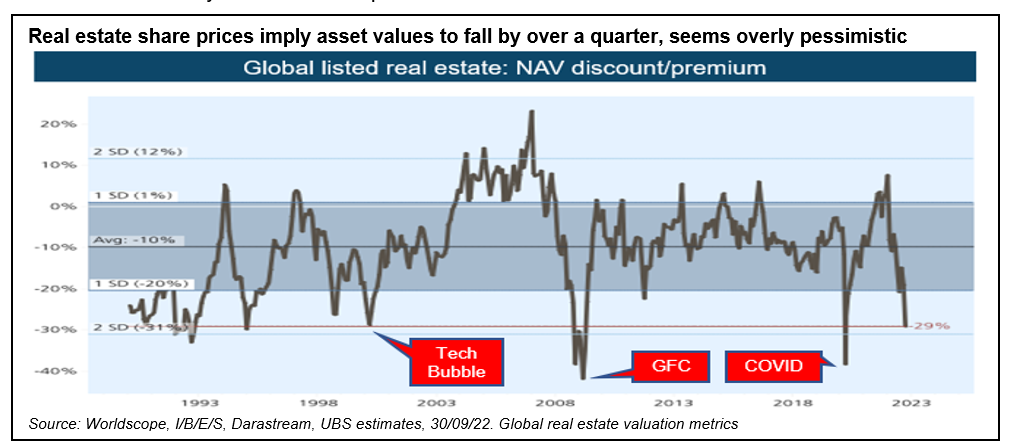

The sell-off, which has been broadly indiscriminate across different sub-sectors of the market, means that the share prices for global listed real estate companies are now at an aggregate 29% discount to net asset values (see chart). This is comparable to the troughs seen during previous recessions and real estate has rarely looked so cheap based on net asset values.

The elephant in the room is capitalisation rates, which are used to estimate the return on real estate investments by comparing a property's net operating income against its market value. The sector has enjoyed multi-year cap rate compression and despite increasing from all-time lows, they still remain below the long-term average. The future direction of cap rates will depend on whether we are moving to a regime of structurally higher interest rates.

Light at the end of the tunnel?

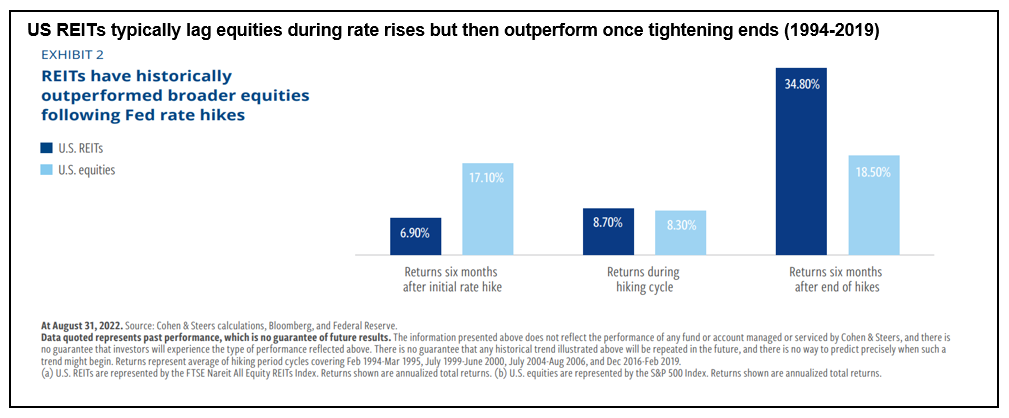

Many economists believe that inflationary pressures are easing as economies slow down and supply bottlenecks improve, which should relieve the upward pressure on cap rates. It is impossible to time the market, but it seems like this period of volatility could be an excellent inception point for the long-term investor. Once inflation starts to slow, interest rate expectations will decline and historically this has seen strong outperformance by listed real estate companies in the subsequent period (see chart).

Meanwhile in Europe, where inflation has largely been driven by supply rather than demand factors, interest rates are expected to peak lower and sooner than the US. This should benefit SKAGEN m2 which has around a third of its portfolio invested in European companies.

Short-term, the fund is positioned to withstand further rises or shocks in interest rates as its 33 portfolio companies have strong balance sheets. Average debt is long-term and interest payments are largely fixed or hedged and well covered by earnings[2]. The portfolio is also highly liquid, which is important at a time when some property funds have restricted withdrawals due to market volatility.

SKAGEN m2 is also well-placed for slowing growth with the majority (57%) of assets invested defensively in segments like data centres, logistics, warehousing, healthcare, self-storage, student housing and residential rental, which are less sensitive to economic activity and provide steady cash-flows. We recently added new holdings in the latter three segments with more details available in our Q3 report. The remainder (43%) is made up of companies in riskier sub-sectors like office, retail and hospitality, which should outperform during economic recovery.

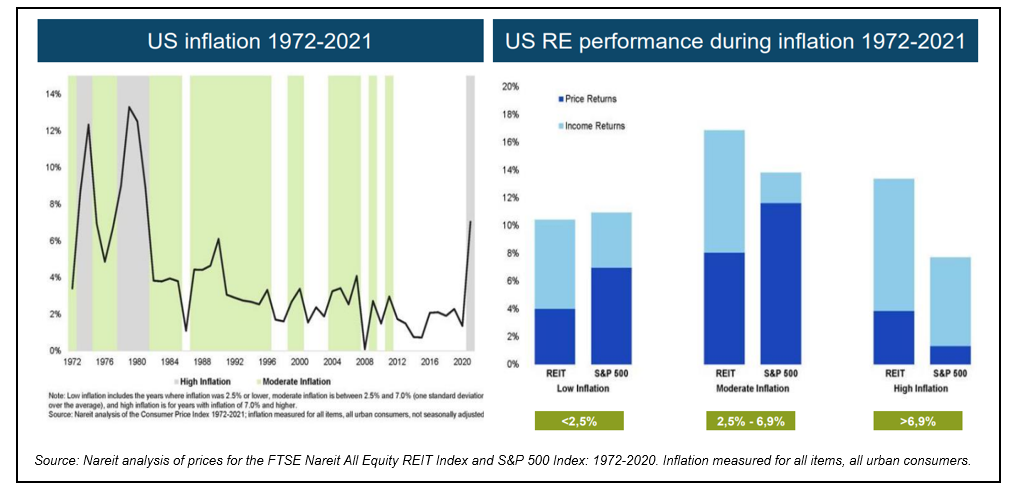

Across the portfolio are companies in trend-driven segments, many with strong pricing power which is especially important during periods of high inflation. The majority have leases with rent increases linked to CPI, which should provide an uplift to near-term revenues. This income growth has been a key driver of listed real estate companies outperforming broader equity during previous periods of high inflation (see chart).

Longer-term, valuation is usually the best predictor of portfolio performance. SKAGEN m2 is well-placed to deliver strong returns over a multi-year horizon with the fund trading at a discount to the index based on multiples of book value, cash flow and earnings[3].

With many companies currently available at attractive valuations, it is a good time to be an active manager but important to stay disciplined. Continued economic turbulence means the immediate outlook for real estate remains uncertain, but for those able to take a long-term view the short-term risks should be well rewarded.

References:

[1] MSCI ACWI Real Estate IMI Net total return index in EUR as at 30/09/2022.

[2] As at 31/08/22. Bloomberg data: Interest coverage ratio 7.4x; Weighted average loan maturity 5.6 years; Average fixed rate debt 77% of total debt.

[3] Source: Bloomberg / SKAGEN. As at 23/09/22 and based on P/B, EV/EBITDA and Earnings Yield.