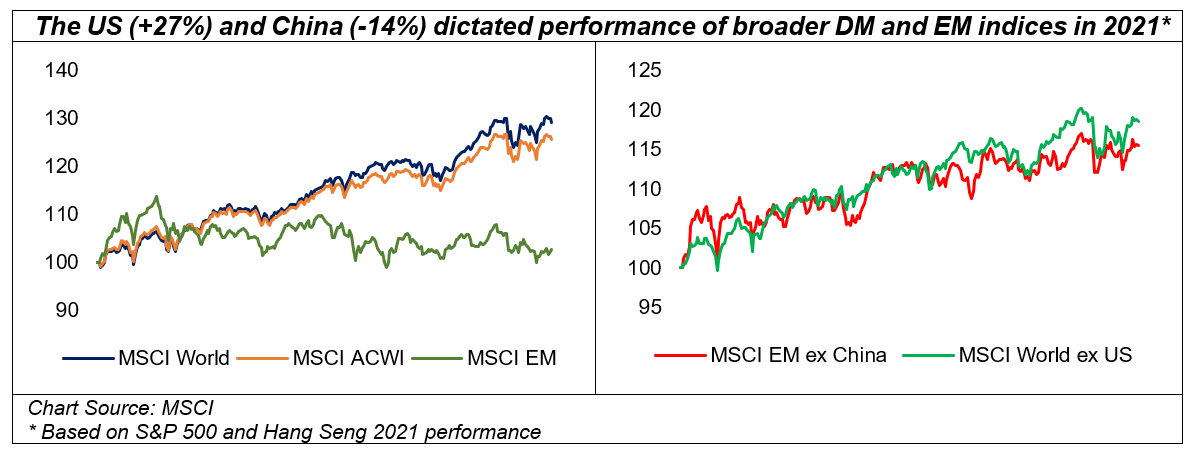

After a helter-skelter 2020, stock markets found relative calm in 2021 and continued to grind out very decent gains for investors. The MSCI All Country World Index reached several new highs before closing 26% higher, although performance below the surface – particularly geographically – was far from even. The disparity between developed markets (+29%) and emerging ones (+2%) was the largest for almost a decade, largely driven by the contrasting fortunes of a persistently strong US and a very weak China, which make up large weightings of the respective indices[1].

Sector performance was more equitable with all delivering double digit returns. Energy recovered from being the worst performer in 2020 to the best in 2021 (+55%), while the performance of real estate (+43%) and financials (+35%) also reversed significantly from the previous year[2]. This helped value to finish 2021 slightly ahead of growth for the first time since 2016, with particularly strong momentum in the first half and fourth quarter[3].

Although volatility fell to more normal levels, the VIX 'fear gauge' remained above average for the second year running as the pandemic continued to cast a shadow across most markets. Companies ploughed ahead regardless, reporting higher profits as demand rose in most sectors. Shortages of commodities and labour, however, meant supply chains struggled to keep pace and inflation overtook COVID as investors' biggest worry.

Central bankers appeared less troubled by rising prices and largely maintained international stimulus programs. With liquidity plentiful, the market remains in positive mood, although it seems inevitable that liquidity taps will be tightened in 2022 – we have already seen the market react strongly to such signals a week into the new year.

Positive fund returns

I'm pleased to report that SKAGEN's equity funds all delivered positive absolute returns in 2021, with each recording all-time-highs along the way. SKAGEN Global and SKAGEN Vekst also outperformed their respective benchmarks, the former by its widest margin for over a decade. You can read more about the fourth quarter highlights for each fund at the links below.

Strong company selection – notably Alphabet (Google), Nasdaq and Intuit – helped SKAGEN Global to close the year over 10 percentage points ahead of the MSCI All Country World Index, which it has also outperformed over 3 and 5-year periods. Morningstar ranks the fund's 2021 performance in the top one percent of its peer group, which is an outstanding result[4].

Superior stock picking also propelled SKAGEN Vekst to its best absolute return since 2009, with the fund's three largest holdings providing its top three contributors. Novo Nordisk contributed most significantly with the Danish pharma company continuing to benefit from the positive launch of its new obesity drug Wegovy in the US.

SKAGEN Kon-Tiki was negatively impacted by China's regulatory tightening and concerns about the financial health of the country's sprawling property sector that dragged on returns for EM investors more broadly. Despite being underweight China, the fund's exposure to Ping An, Alibaba and Tencent (via Naspers) outweighed positive contributions from holdings such as UPL and Ivanhoe Mines.

SKAGEN m² generated strong absolute gains as real estate markets surged in 2021. The fund's underweight exposure to the US, which had its best ever year, provided a headwind to relative returns. However, the fund's strong stock picking was evidenced by a record number of take overs both within and outside its portfolio, including one of the competitors to the fund's largest holding Self Storage Group, which was the best contributor in the fourth quarter.

Underweight exposure to a strong US market also proved challenging for SKAGEN Focus which similarly delivered impressive absolute returns but lagged its benchmark. Our small and mid-cap focused fund also saw record M&A activity within its portfolio, which the managers forecast to have over 50% upside.

Finally, our fixed income funds also generated solid absolute terms but lagged their respective benchmarks over the year. SKAGEN Tellus looks well positioned to navigate interest rate volatility in 2022 and rising long-term bond yields, notably in developed markets.

Opportunities still knocking

Stock markets will do very well to sustain last year's bumper returns and investors shouldn't be surprised if 2022 proves to be more challenging with gains harder to find. For experienced stock pickers like SKAGEN, however, this should play to our strengths. Global equities have risen 250% over the past decade but these rewards have been unevenly distributed[5]. While quality growth stocks trade at historically high valuations – an unprecedented 83 companies in the S&P500 currently trade above 10x sales – the relative underperformance of segments like emerging markets and capital-intensive industries provides real opportunities. The shift towards a greener, more sustainable environment also offers attractive openings for companies in many different sectors.

With global GDP forecast to grow a further 4.9% in 2022[6], economic conditions should be supportive for company earnings, particularly if Omicron proves to be less harmful and shorter-lived than previous variants. Such good news would also provide a welcome boost for emerging markets, many of which have not yet benefitted from a reopening of their economies, even if a fairer distribution of COVID vaccines in 2022 may be too much to hope for.

With central banks beginning to share investors' concerns over inflation, interest rates look odds on to rise in 2022, which should be positive for value investors like us – particularly if tightening can be achieved without choking the economy. We have already seen a sharp rotation from technology stocks into financial and industrial ones at the start of year, triggered by Fed comments that US interest rates are likely to happen sooner or faster than previously expected.

What about risks? The biggest threats this year could be geopolitical. The US has challenges at home and its influence abroad has waned at a time when the threat from volatile leaders in Russia and China has increased. North Korea has been unnervingly quiet for some time and President Erdogan could face challenge if Turkey's economic problems worsen.

These issues and many more were debated at our New Year's Conference where the theme was 'Investing in the Age of Global Transformation'. If you missed it, I would encourage you to watch the recordings here.

2022 certainly promises to be an action-packed year and I look forward to updating you on our progress.

NB: Attribution based on absolute return in NOK

Footnotes:

[1] Performance figures in EUR (source: MSCI)

[2] S&P 500 sector returns in USD (source: J.P. Morgan)

[3] Source: MSCI in EUR (ACWI Value Index +25.8% vs. ACWI Growth Index +25.2%)

[4] Source: Morningstar, Global large-cap blend equity

[5] MSCI All Country World Index return in EUR, 2011-2021

[6] Source: IMF, World Economic Outlook, October 2021