"Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man." – Ronald Reagan

We wrote recently about some of the structural factors driving inflation and asked whether it was here to stay? In its latest economic outlook, the OECD leaves little doubt what it thinks:

"The war in Ukraine has quashed hopes for a quick end to rising inflation from COVID-19 related supply bottlenecks seen across the global economy during 2021 and early 2022. High food and energy prices and the continued worsening of supply-chain problems imply that consumer price inflation will peak later and at higher levels than previously foreseen."

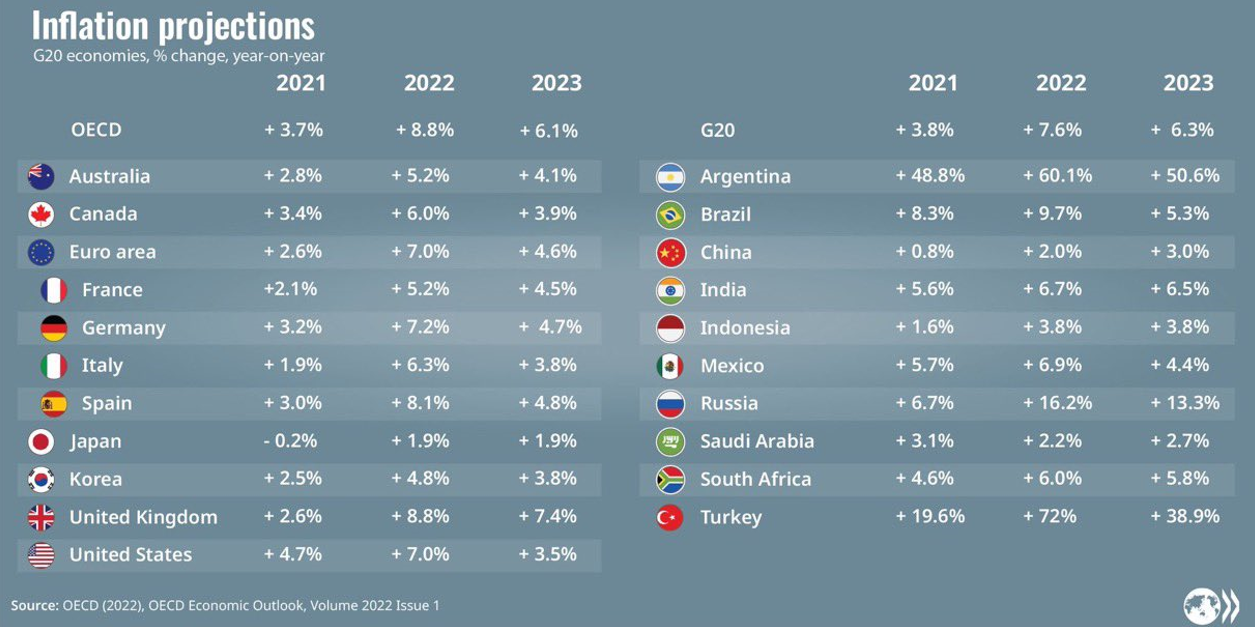

The report forecasts headline inflation to be 8.8% in developed countries this year, up from 3.7% in 2021. Although less dramatic than Reagan's characterisation, it spells out the harmful effects of rising prices that are "causing hardship for low-income people and raising serious food security risks in the world’s poorest economies. …. The sharp rise in prices is already undermining purchasing power, which will force lower income households worldwide to cut back on other items to pay for basic energy and food needs."

Summit in sight?

Inflation projections have been revised upwards across the board but there is some good news. Price rises are starting to peak in many countries with the OECD predicting a headline fall to 6.1% in 2023. This is largely because central banks are raising interest rates to cool demand for goods and services, although there is little they can do about the significant food or energy inflation caused by the ongoing war in Ukraine that is eating into household budgets.

However, the latest data from the US showed that prices rose faster than expected with inflation climbing to 8.6%, its highest rate since 1981. May's price rises permeated a wide range of goods and services, putting further pressure on the Federal Reserve.

Monetary decision-makers are on a knife edge; tighten too much and economies could be pushed into recession, while too little risks entering a spiral of worsening wage-push inflation. Some, like the US and UK, have already raised lending rates steeply this year and are expected to continue. Their hope is that strong labour markets, combined with high levels of household savings and low debt, will help to maintain economic momentum.

The balance to achieve a 'soft landing' is particularly delicate in Europe where inflation recently surged to 8.1%. In response, the ECB will raise interest rates by 25bps in July for the first time in over a decade, but with EU countries expected to deliver sluggish economic growth amid falling business and consumer confidence there is little margin for error to avoid recession.

Implications for investors

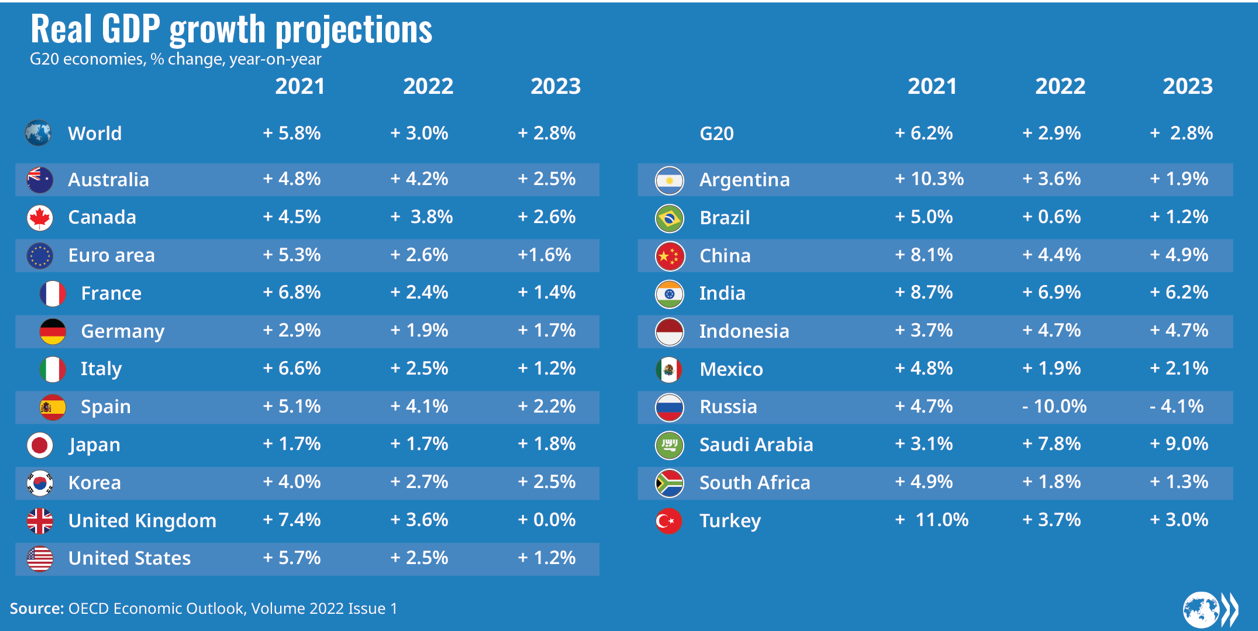

Despite downgrading forecasts, the OECD believes economic growth will remain positive with global GDP expanding 3.0% this year and 2.8% in 2023. All major economies except Russia are predicted to avoid recession and they see little risk of repeating the 'stagflation' of the 1970's when high inflation met surging unemployment.

For value investors like SKAGEN, continued economic growth (even if weak) and higher interest rates should be supportive, certainly compared to those invested (either actively or passively) in growth companies. We have been predicting high inflation and a normalising of unrealistic valuations for some time so the rotation from growth to value we are currently seeing is unsurprising.

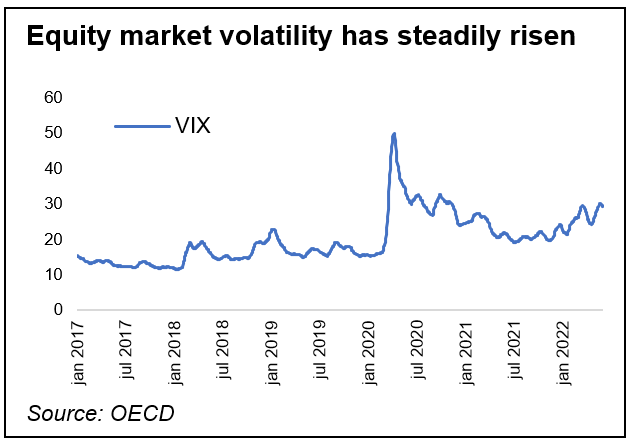

Uncertainty surrounding the global economy has created volatility in stock markets with several large swings and companies' shares moving violently, particularly on bad news. The VIX index that measures US equity volatility has climbed steadily and been above its long-term average for most of this year. We are also seeing divergence across countries and sectors, for example energy is up around nearly 50% so far in 2022 whereas retail has fallen by over 25%[1]. This creates a good environment for stock-pickers who have the flexibility to exploit attractive corners of the global market. Our funds have used the volatility to sell holdings at attractive prices and buy others at bargain valuations. You can read about recent portfolio activity in the latest monthly reports.

Finally, it is natural that negative headlines and jittery stock markets can be uncomfortable but history teaches us that the best time to invest is when sentiment is at its most pessimistic. The current mood may be gloomy but a diversified stock portfolio still provides the best protection against the silent assassin of inflation and route to maximising long-term risk-adjusted returns.

[1] MSCI World Energy Index (+46.55%) vs. MSCI World Retailing Index (-26.76%) in USD, as at 31 May 2022