It is emblematic of human psychology to link equity market returns to the current picture of the world reported in media. It has always been that way and always will be. The human mind is unlikely to change.

However, this type of short-term thinking is typically detrimental to long-term investing. Those who heeded the doomsayers' advice of partly staying on the sidelines, or even worse, exiting the stock market altogether at this point last year, now find themselves having missed out on a year of superior stock market returns, meaningfully above the long-term average annual return.

SKAGEN Global has achieved an absolute YTD return of 12.6% in EUR[1]. Many of our holdings, which typically are characterised by exhibiting strong fundamentals, enviable competitive positions, robust balance sheets and well-aligned management teams, have delivered solid performance. Moreover, the absolute return achieved by the fund over the past few years equals 9.4% per year on a 3-year basis and 12.0% per year on a 5-year basis measured in EUR[2].

In relative terms, the fund is currently 4.3% behind its reference index MSCI AC World YTD, a gap we hope to close and exceed in coming periods.

Long-term holdings deliver positive returns

Year to date, the fund's 3 best performers are Microsoft, Alphabet (Google) and Moody's. It will not come as a surprise to market observers that the American big tech companies have had a stellar year. The newfound acronym "The Magnificent Seven" is essentially an adaptation of the previous FAANG moniker and includes Apple, Microsoft, Alphabet (ex-Google), Meta (ex-Facebook), Amazon, Tesla and Nvidia. As a group, this collection of mega-cap stocks has widely outperformed in 2023 powered by a mixture of factors ranging from artificial intelligence and subsiding inflation to earnings growth and balance sheet resilience. We have long argued that Microsoft and Alphabet are undervalued and both companies have been part of the SKAGEN Global portfolio for well over a decade. In fact, since SKAGEN Global entered Microsoft in 2010 the stock has achieved a staggering total return of 32x measured in NOK[3].

We continue to see upside in both names. However, we are not inclined to go on a buying spree and stuff the portfolio with US big tech stocks because we believe such concentration risk would not be prudent from a diversification perspective. By extension, our risk management principles mean that in a year when the Magnificent Seven stocks which dominate the index with their huge market capitalizations (the combined weight of the Magnificent Seven in the MSCI AC Index now exceeds the index weight of all stocks included from China, Japan, France and the UK), we will face some headwinds on a relative basis by not owning all of them. So be it. We are in it for the long run and our risk management practices have served the fund's unitholders well over the past few years as demonstrated by our avoiding geopolitical meltdowns as well as the US regional banking debacle to name just a few specific examples. We will continue to adhere to our risk management discipline while acknowledging that we may not always be correct.

Moving on to the third top-3 performer, the credit-rating agency Moody's, which has had a stellar year as the forward-looking market is now beginning to anticipate that companies will ramp up their issuance of new bonds once interest rates are seen to be past peak levels. As we have stated repeatedly, trying to predict interest-rate levels or short-term bond-issuance trends is a fool's errand and something we do not even attempt. More importantly, the secular trend of increasing bond issuance at the expense of traditional bank financing is alive and well. Moody's remains undervalued and is a core holding of SKAGEN Global at current valuation levels.

Consumer Staples weakness

On the negative side, year to date the same three black sheep have occupied the bottom-3 spots for most of the year: Dollar General, Estee Lauder and Nasdaq. We have commented extensively on these names in previous updates and will not re-hash the background here. Suffice it to say that the combination of constrained consumer spending with internal operational hiccups has resulted in significant declines of the share price in Dollar General and Estee Lauder. The decline in these two names largely explains the entire relative underperformance YTD for the fund. However, we continue to believe that there is ample room for these companies to recover and the share price declines appear excessive.

In our experience, it is neither surprising nor unnatural that the share price will be pushed (far) below the intrinsic value as a company falls out of favour with the market. It almost has to be that way as the market tests the limit at which existing shareholders would be willing to part with their shares. This phenomenon is a key ingredient in the greed-and-fear-psychology that often rules markets in the short term. In the same vein, it is this type of overreaction dynamics that may create compelling buying opportunities for long-term investors as long as the intrinsic value of the company remains far above the dislocated share price. Indeed, we have used this opportunity to buy more in both companies because we assess their risk-reward profile attractive at current levels. Green shoots are already visible. Dollar General recently re-hired its former star-CEO Todd Vasos and the stock jumped nearly 10% on the announcement in the biggest one-day gain since May 2022.

Regarding the third detractor, Nasdaq, in our view the company vastly overpaid for a large acquisition earlier in the year and we promptly exited the position as we deemed management's capital allocation to be subpar.

Holdings well positioned for current environment

The portfolio remains concentrated with around 30 holdings. For the entire year, we have not owned any positions in four sectors: Energy, Material, Real Estate and Utilities. It is worth noting that these four sectors have considerably underperformed the index on a relative basis, thus supporting our view and fundamental analysis that they were not particularly ripe with opportunities (although the rare exception on a company-level may well have existed).

Furthermore, we note that this year the health care sector was primarily held up by the obesity pill pharma companies. While we are intrigued by the science behind the novel weight-loss medicine, we do not think that all the world's health problems will go away any time soon due to this discovery. Therefore, the more pedestrian share price performance YTD by many other health care companies, including those owned by us, represents an opportunity for attractive future returns, in our view. We continue to contend that health care is one of the most fundamentally attractive sectors for long-term investors. It is one area where we focus on building knowledge based on first principles to enhance our ability to identify undervalued long-term winners in this sector. More on this topic will follow at a later date.

Most of our holdings have now reported Q3 earnings. We have digested the quarterly reports and updates with great interest and conclude that our companies generally seem well positioned for the current environment.

Before closing with a few words on the 2024 outlook, we also want to remind our unitholders that the fund is ready to take full advantage of our unconstrained mandate if the right opportunity presents itself. We have not seen a crash in any of the more commodity-oriented sectors this year, so we remain disciplined with the finger on the trigger until the fickle market serves up one or more of those rare opportunities in the more cyclical sectors.

Resilient portfolio ready for a variety of macro scenarios

As we look ahead to 2024, it is increasingly clear that many market participants are assuming a positive development for the economy and lower interest rates going forward. While we can certainly see the rationale for such thinking, it is not obvious to us that this scenario is as likely to play out as the present market sentiment indicates. We also note that the impressive stock market rally in 2023 may reverse abruptly if inflation does not subside as quickly as the market now assumes. If that were to be the case, some of the high-flying names in 2023 would likely see meaningful declines. Hence, we believe a resilient portfolio built bottom-up and ready for a wide variety of macro scenarios is a prudent way to enter 2024. SKAGEN Global is designed to meet this criterion.

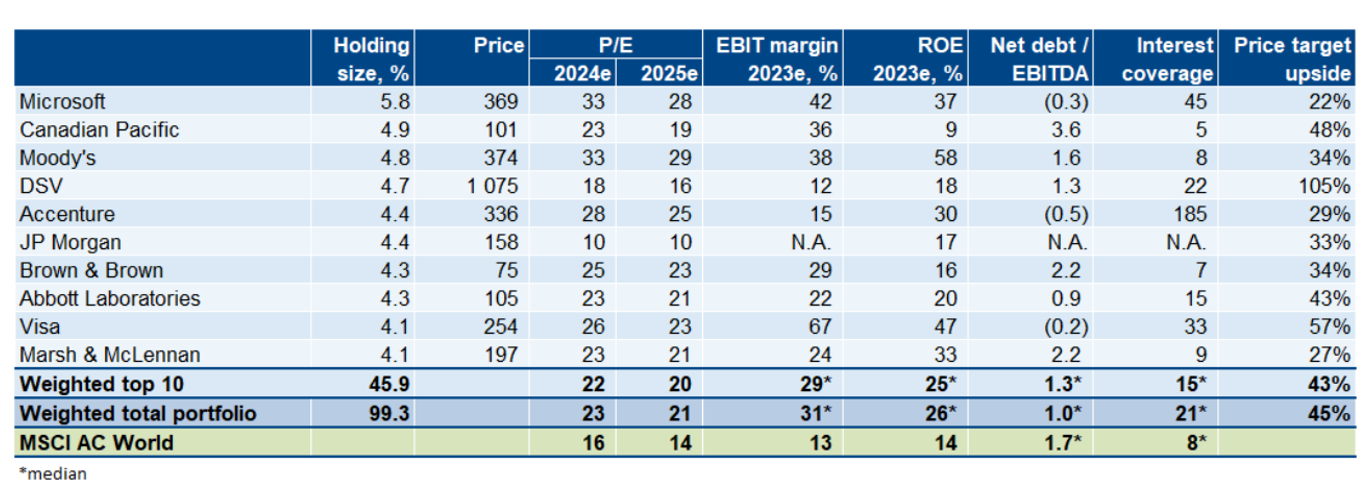

Though we frequently emphasise the need for solid cash flow and healthy balance sheets, the composition of the fund is intended to give the portfolio both offensive and defensive qualities while delivering attractive long-term returns. As detailed above, SKAGEN Global has delivered 12% return per year over the past five years (in EUR). The table below shows our top-10 list with select metrics as of 30 November 2023. The weighted-average portfolio upside over the next few years is 45%, demonstrating that our financial analysis indicates there is still substantial upside in the fund going forward.

In addition to the inherent recovery potential in Dollar General and Estee Lauder, there is plenty of upside in the transportation names DSV, Canadian Pacific and Mainfreight. We also think that our health care holdings are full of latent value that may be more appreciated by the market in 2024.

We thank you for the continued support and wish every reader of this update a happy holiday season.

[1] As of 20 December 2023

[2] As of 20 December 2023

[3] Source: Bloomberg. The time period is 14 Sep 2010 – 14 Dec 2023.