Stocks have generally gyrated sideways as investors have digested the different signals from economic data, vaccine roll outs and the earnings season.

These key indicators have been increasingly positive. According to the latest Bank of America Global Fund Manager survey, 91% of investors expect the economy to strengthen – its most bullish outlook since the barometer began in 1994. Growing confidence is also reflected in record investor risk appetite and their current overweighting of cyclical sectors (commodities, industrials) and underweighting of defensive ones (energy, consumer staples) versus their historical sector exposure.

The outlook is similarly positive for global equity fund SKAGEN Global and its carefully selected stocks, as Lead Portfolio Manager, Knut Gezelius, explains: "Several of our core holdings will be boosted as the world emerges from lock-down. Increased travel will benefit Visa and MasterCard, as well as Google which receives significant advertising revenue from travel companies." Another portfolio example is luxury goods group LVMH which saw revenues decline 17% in 2020, but said recently that it was cautiously confident for this year and "well-equipped to build upon the hoped-for recovery in 2021 and regain growth momentum for all its businesses"[1].

The prospect of economies re-opening has lifted the MSCI ACWI Airlines Index by around 20% since the turn of the year while hospitality companies are also up significantly and the MSCI ACWI Hotel, Restaurant and Leisure Index has recovered to pre-pandemic levels.

Gezelius continues: "The recovery will also benefit supporting companies, for example the Faroese salmon farming company Bakkafrost whose superior fish typically command a premium when sold to high-end restaurants, but less so when delivered in frozen packages to grocery stores." Waste Management, which provides collection and recycling services in North America, should also benefit. The US company expects revenue growth of between 10.75% and 11.25% in 2021 compared to a fall of 2% last year as it suspended price increases for customers impacted by the pandemic[2].

Other beneficiaries are expected to be companies providing private medical services as many non-urgent procedures were postponed during the pandemic and those linked to infrastructure, which should receive increased investment during recovery (see figure 1).

SKAGEN Global's portfolio is concentrated in 30 holdings with strong balance sheets, underlined by a median net debt / EBITDA (earnings before interest depreciation and amortisation) ratio of 0.3x, well below the MSCI All Country World Index average (2.0x). Their underlying revenue exposure[3] is evenly split between US / non-US and they come from a range of sectors and industries with diversified revenue drivers. Gezelius adds: "The portfolio is positioned to deliver attractive returns in a wide variety of macro and market scenarios with weighted upside of 43% over 2-3 years based on current price targets".

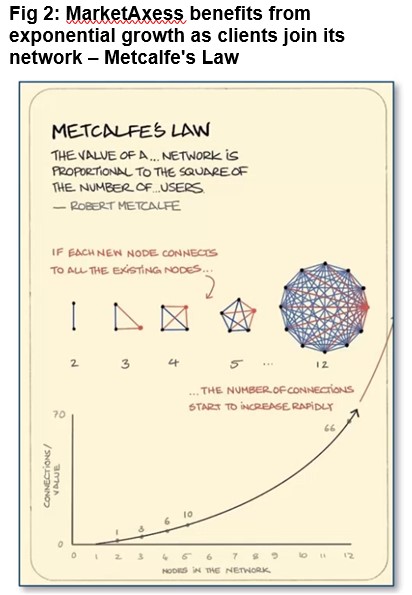

Leveraging Metcalfe's Law

A company which is likely benefiting from the recent bond market volatility is MarketAxess, which joined the SKAGEN Global portfolio in the final quarter of last year. The US company, which is currently a 3% position in the fund, provides electronic trading for fixed income products. Unlike equities, which have become increasingly easy to trade online – the Robinhood/Reddit frenzy also grabbing recent headlines is evidence of this – credit trading uses a low degree of electronification and is ripe for a secular shift from analogue to digital.

MarketAxess is well-placed to lead this charge having grown steadily to become the dominant electronic provider with a market share exceeding 20%, but we believe there is huge potential for further gains given analog trading still accounts for 72% of activity[4]. At $23 trillion[5], the bond market is of comparable size to equities ($26 trillion) and expected to grow further, driven by the rise of fixed income ETFs and leveraged buyouts by private equity.

If MarketAxess continues to grow its share of an expanding market it should benefit from a powerful network effect – Metcalfe's Law – which would become increasingly valuable (see figure 2). Amazon followed a similar trajectory and MarketAxess shares its growth-centric business model and strategy of passing on low costs to customers to boost their experience and volumes.

Gezelius concludes: "SKAGEN Global is well placed to ride the anticipated economic rebound ahead. Our holdings generally reported encouraging results for 2020 and are now investing to further strengthen their competitive positions and drive cash flow generation in the years to come. Based on the portfolio's attractive valuation, our outlook for the fund is similarly positive, both for the near-term economic recovery and our long-term investment horizon."

All information as at 28 February 2021 unless stated

References

[1] Source: LVMH 2020 Annual Report

[2] Source: Waste Management 2020 Earnings Press Release

[3] Based on 2019 sales or best available estimate by Bloomberg / SKAGEN Global

[4] Combined market share in high-grade and high-yield bond trading; MarketAxess 2021 Q1 Investor Presentation

[5] Source: MarketAxess