1. What's happening in stock markets?

The S&P 500 index of the largest US companies fell 3.9% on Monday and is now down more than 20% from its January all-time high – a threshold known as a bear market.

Bear markets are a regular occurrence in stock markets. The S&P 500 has experienced 12 such declines since World War II with the last one occurring in March 2020 at the start of the pandemic. The 20% threshold is symbolic and a psychological marker for investors – it has historically been a buy signal and a good time to invest when share prices are discounted.

2. What about other international stock markets outside the US?

Most international markets have experienced similar declines (some like the technology-heavy NASDAQ Composite index have been in a bear market for several weeks). The MSCI All Country World Index is down 18% year-to-date.

Emerging markets (-14%) have performed better than developed (-19%) ones, despite Russian stocks suffering heavy losses and the Moscow Stock Exchange being closed to international investors for much of the year. Value (-10%) has also held up better than growth (-27%). A lot of growth companies – many in the technology sector – were trading at expensive valuations and they have been hit particularly hard by rising interest rates which reduce the present value of their future profits[1].

3. What's caused the market to drop? Is it just higher interest rates?

No. Investors are worried by inflation which is high and continues to rise. The US unexpectedly announced on Friday that consumer prices climbed 8.6% in May with inflation appearing to spread through the economy beyond fuel and energy, where Russia's invasion of Ukraine has caused prices to rise dramatically. This is hurting consumer confidence and spending, which will reduce company profits and could cause a recession. US retailers Target and Walmart – seen by many as economic bell-weathers – both recently announced falling profits and blamed inflation for increased costs and lower sales, particularly of bigger-ticket items like TVs and furniture.

Investors are also increasingly concerned that in attempting to fight inflation, central banks may raise interest rates too steeply and push economies into recession. In the US, speculation that the Federal Reserve could raise interest rates by 0.75% this week is growing and markets now expect borrowing rates to reach 3.6% by the end of the year, compared with 2.9% before Friday's shock inflation figures. In Europe, where interest rates have been negative for over eight years, the ECB recently signalled a 0.25% climb in July and the possibility of further hikes in September.

3. How long would a bear market last and how much further could stock markets fall?

Previously the S&P 500 took 14 months on average to recover losses of between 20% and 40% and 58 months to recover declines above 40% which only happened on three occasions (1973, 2000 and 2007). Bear markets don't always coincide with or cause economic recession. Indeed, several previous post-war sell-offs stopped at around the 20% mark and recession was avoided.

There are encouraging signs that inflation is starting to peak in some countries and labour markets generally remain strong, which should help economies to continue growing. If central banks can successfully deliver a soft economic landing then we should hopefully be closer to the end of the current bear market than the beginning. In its economic outlook report released last week, the OECD expects economic activity to fall globally over the next 18 months but recession to be avoided.

4. What is SKAGEN doing?

We are lucky in SKAGEN to have an experienced investment team who successfully navigated funds through previous bear markets during the pandemic and global financial crisis. I have written previously about how they apply their knowledge of investing during times of market stress and our long-standing investment processes also ensure that clients receive the best possible portfolio protection.

SKAGEN's broad mandates allow us to invest where we see the best opportunities and our active approach enables us to make investments quickly when opportunities arise. All sectors apart from energy are down this year which means that attractive companies are available at knock-down prices, particularly in consumer, technology, real estate and financial services which have fallen furthest. You can read about our funds' new investments in the latest monthly reports.

5. What should I do?

History teaches us that the best time to invest is when markets are at their most pessimistic and the current mood is gloomy. Bank of America described it as “extremely bearish” in its latest monthly investor survey and found their highest cash allocations since 9/11.

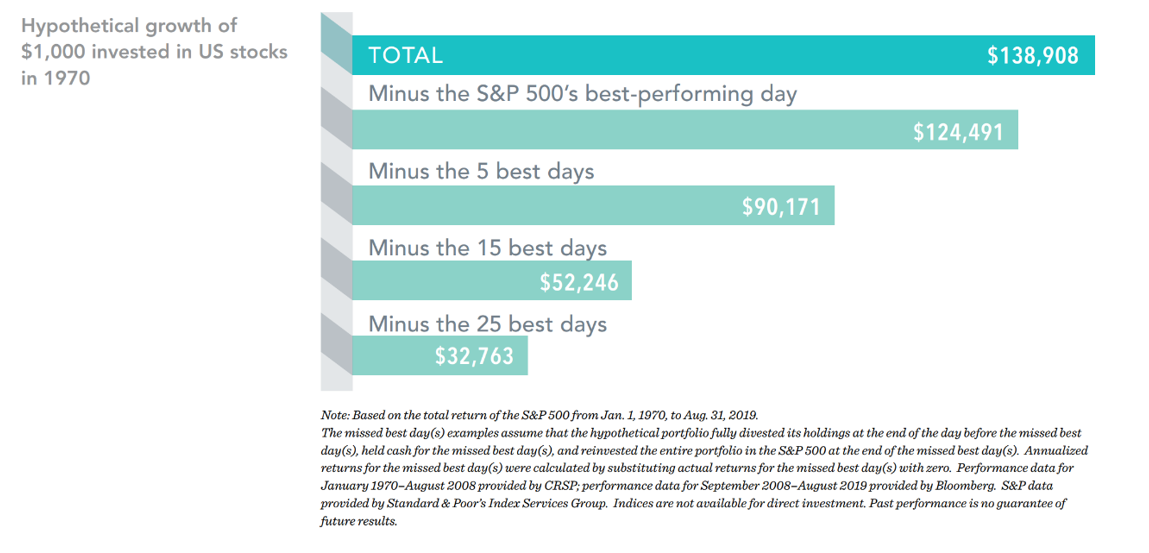

Although moving to cash may be tempting, bank savings will inevitably lose their value in real terms with inflation running at close to double-digits. Market falls can be painful but paper losses only crystalise financially when you sell. Selling also risks being out of the market on positive days which have been a feature of the recent volatility. A study recently showed that missing only a handful of the best-performing days between 1970 and 2019 would cut returns by over 35%, which puts the current market falls into context.

[1] Source: MSCI in local currency as at 13/06/22. EM=MSCI EM Index, DM=MSCI World Index, Value=MSCI ACWI Value Index, Growth=MSCI ACWI Growth Index.