SKAGEN Kon-Tiki has started 2023 strongly, climbing 7.5%[1] in EUR; 2.5% higher than the MSCI Emerging Markets Index. These impressive returns extend its strong end to 2022 when the fund overtook its benchmark and ended the year 2.0% ahead of its benchmark.

Among the fund's top 2022 contributors were Cnooc and TotalEnergies – energy was the only stock market sector to deliver positive absolute returns last year largely thanks to rising prices – as well as materials holdings Turquoise Hill and Ivanhoe Mines; two companies mining the copper necessary for the energy transition.

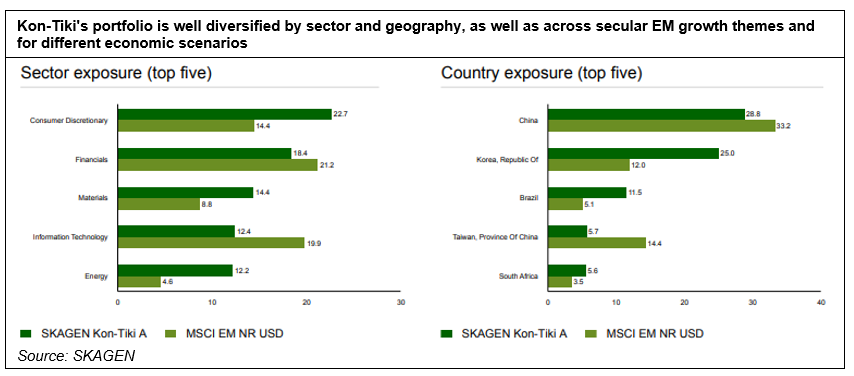

In addition to helpful energy headwinds – SKAGEN Kon-Tiki has 12.2% of assets invested in the sector versus 4.6% of the index – performance was boosted by strong stock selection. This was particularly notable in China where the fund's holdings contributed positive absolute returns and outperformed the weak Chinese market by over 20 percentage points.

The largest detractors were Sberbank, Magnit and X5 Retail Group – the bulk of Kon-Tiki's Russian holdings remain valued at zero pending any reopening of the Moscow Stock Exchange – in addition to LG Electronics and Samsung Electronics. The Korean holdings were dragged down by domestic market fragility in 2022 but both remain high conviction (top five) positions in the fund.

Price-driven, high-quality portfolio

Our price-driven approach is reflected in SKAGEN Kon-Tiki's portfolio valuation which remains heavily discounted despite strong recent outperformance. The fund is priced 40% cheaper than the index on a Price/Earnings basis and 50% lower using a Price/Book multiple[2]. Relative to peers, the fund's portfolio is even more attractively positioned, ranking among the very best priced global emerging market funds using the same P/E and P/B multiples[3].

At the same time, our holdings are benefitting from – and often driving – secular emerging market growth across different themes like health and well-being, technology leadership and the energy transition. The portfolio's quality is reflected in it being ranked in the top decile in terms of its Return on Equity against the same peer group of emerging market funds³.

SKAGEN Kon-Tiki is also hedged for a range of potential macro environments in terms of economic growth and levels of inflation. We have built a portfolio of companies across sectors that do well in different scenarios, which is particularly important given the uncertain outlook.

The portfolio's largest sector exposures relative to benchmark remain energy and materials, although both have recently been reduced as company gains have been realised. On a geographic basis, while China is the largest exposure in absolute terms, the fund is most overweight in Korea and Brazil.

Brazilian boost

SKAGEN Kon-Tiki's Brazilian holdings provided a boost to fund performance in 2022 with the country among the best performing EM markets with gains of 14.2%[4]. The portfolio managers believed Brazil to be attractively valued at the start of the year and selectively increased exposure by adding Cosan, Raizen and Banco do Brasil to the portfolio.

Alongside our Head of ESG, Sondre Myge, the Kon-Tiki team visited Brazil in January to gain a closer understanding of our holdings, their production facilities, supply chains and the management teams running them. This unique access also allowed us to glean important sustainability insights, including the companies' use of natural materials and role in the circular economy. You can read more about the trip in our Brazilian travel letter.

To conclude, SKAGEN Kon-Tiki looks well-placed to continue delivering strong performance. A combination of good stock selection and price discipline has created a portfolio of quality companies primed to perform in a range of different scenarios with the downside protection provided by discounted valuations.

Learn more about our exciting portfolio and recent trip to Brazil in our video update.

All information as at 31/01/2023 unless stated.

[1] Source: SKAGEN, as at 21/02/2023

[2] Source: SKAGEN, based on top 35 holdings

[3] Source: Copley, as at 31/12/2022

[4] Source: MSCI. MSCI Brazil Index in USD