Many of last year's gains came from Asian markets, reflecting their faster recovery from the pandemic and exposure to attractive cyclical and structural growth drivers. This was epitomised by top performing South Korea, which rose 30% in EUR terms, as its blue-chip companies were boosted by recovering demand for memory chips and the longer-term shift towards electric vehicles.

It was by no means plain sailing with the March global drawdown hitting the developing world disproportionately hard and countries dependant on commodities (e.g. Brazil and Russia) or tourism (e.g. Thailand and Turkey) enduring a difficult year. However, for emerging market investors generally, their resilience in the face of significant uncertainty was reassuring and a source of optimism for the future.

Strong returns

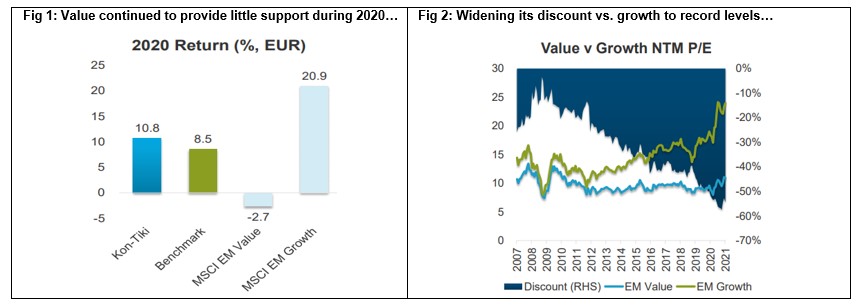

SKAGEN Kon-Tiki ended 2020 a little over 2% ahead of the MSCI EM index, a particularly strong result given the value factor provided a continued headwind for the fund's investment style and underperformed the growth equivalent by the widest margin since the dot com bubble (see figure 1). November proved pivotal, however, as vaccine breakthroughs and the US election result saw value rebound. Kon-Tiki rode the recovery to beat the MSCI EM index by over 7% in the final quarter, which illustrates the portfolio's latent potential and bodes well if value maintains its revival.

Despite a year-end rally, the valuation gap between value and growth remains at record levels with value currently 54% cheaper based on forward earnings (see figure 2) and 72% lower on a P/B basis. Given value's return on equity (ROE) discount to growth is a slender 4%, the valuation chasm looks increasingly difficult to ignore and with it the likelihood that fundamentals will drive share price performance once more.

Korea provided half of Kon-Tiki's ten best contributors in 2020, led by LG Electronics and Samsung Electronics with both companies benefitting from home working during the pandemic and a particularly strong fourth quarter. It remains the portfolio's largest country exposure at 24% of the fund as we continue to find value in well-run Korean companies, often via their heavily discounted preference shares.

The main drag on returns came from the banking sector via our holdings in State Bank of India and Banrisul, which were hurt by interest rate cuts and concerns over loan losses as a result of the pandemic, in addition to weak performance from Aeroflot, Shell and China Unicom. We exited most of these during the year to limit our losses, a move which contributed positively to the fund's relative return.

Accelerated idea generation

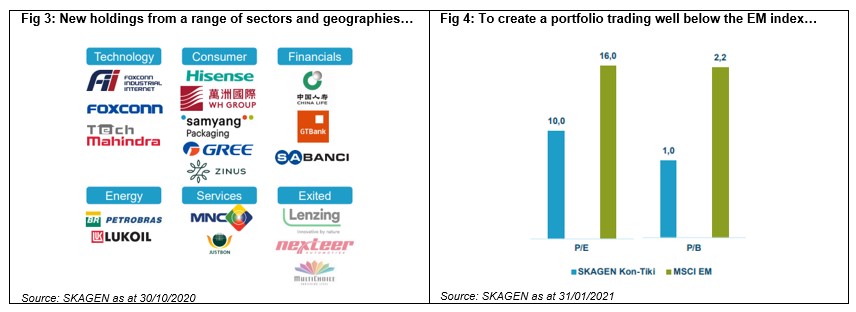

The capital was redeployed into new holdings across a range of sectors, including technology and consumer goods where valuations were particularly attractive during the market dislocation (see figure 3). In total, 20 new companies entered the portfolio in 2020 – the same number as the previous two years combined – and we maintain a strong 'hot pot' of new ideas to keep the bar high for those in the fund to remain there.

The result is a portfolio diversified by sector, geography and company size which trades at an increasingly attractive valuation. Its discount relative to the market has widened to 38% on earnings and 55% on book value multiples as the portfolio managers were able to reinvest capital gains into lower valued opportunities throughout the year (see figure 4).

Valuations more broadly have risen in anticipation of economic recovery, particularly in developed markets where there are growing signs of bubbles forming. A quarter of US trading currently involves stocks considered expensive (i.e. Enterprise Value / Sales above 20x) while less than a third have outperformed the S&P 500 index over the previous 12 months, a level last seen during the Nifty Fifty and dot com bubbles. Meanwhile record flows – often debt-financed and from retail investors – are going into new listings, special purpose acquisition companies (SPACs) and loss-making businesses, all of which indicate danger ahead.

Staying selective

Despite the lofty multiples and growing threat of bubbles, 2020 illustrated that there remain pockets of value, particularly in emerging markets where we see a healthy pipeline of quality companies at attractive valuations. The growing dispersion of returns underscores the benefits of an active approach – Kon-Tiki's active share remains high with 87% of the portfolio invested away from the index – particularly if value's resurgence gathers momentum.

We believe the selection of strong companies at sensible valuations based on conservative expectations is the best way to navigate the emerging market revival following COVID. The economic recovery will likely be volatile with uncertainty over vaccine supplies creating further risks across the region, but Kon-Tiki looks well-placed to continue steering a profitable path for our clients.

Is this the year of Emerging Markets? See portfolio manager Fredrik Bjelland's outlook: