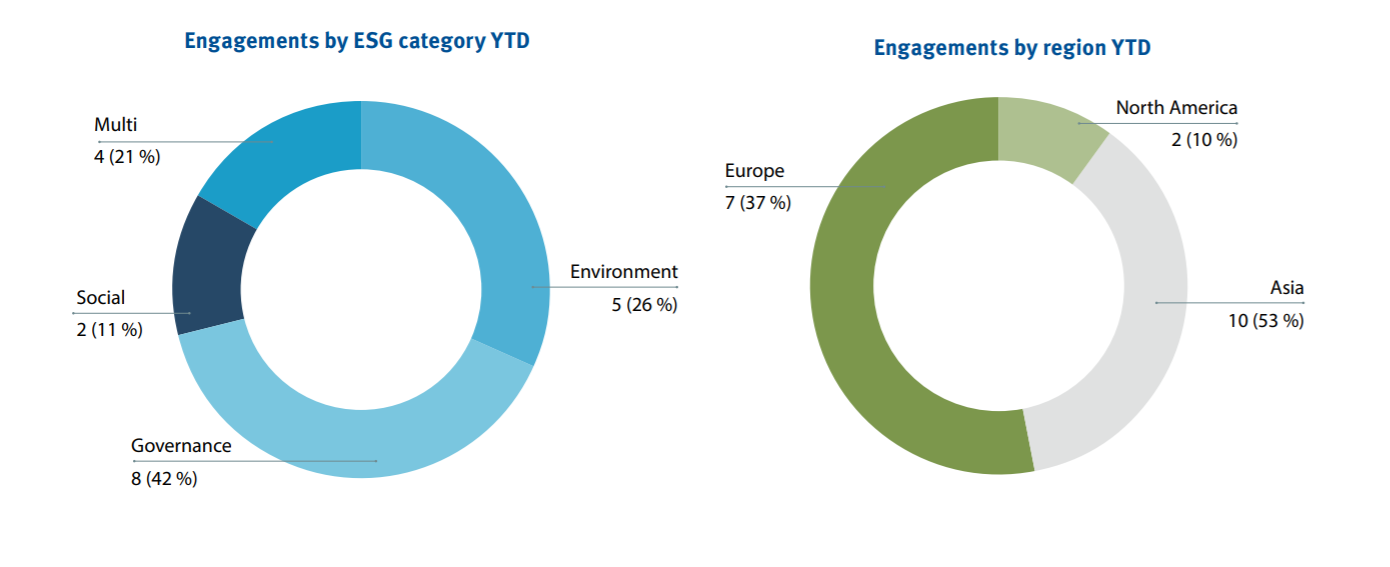

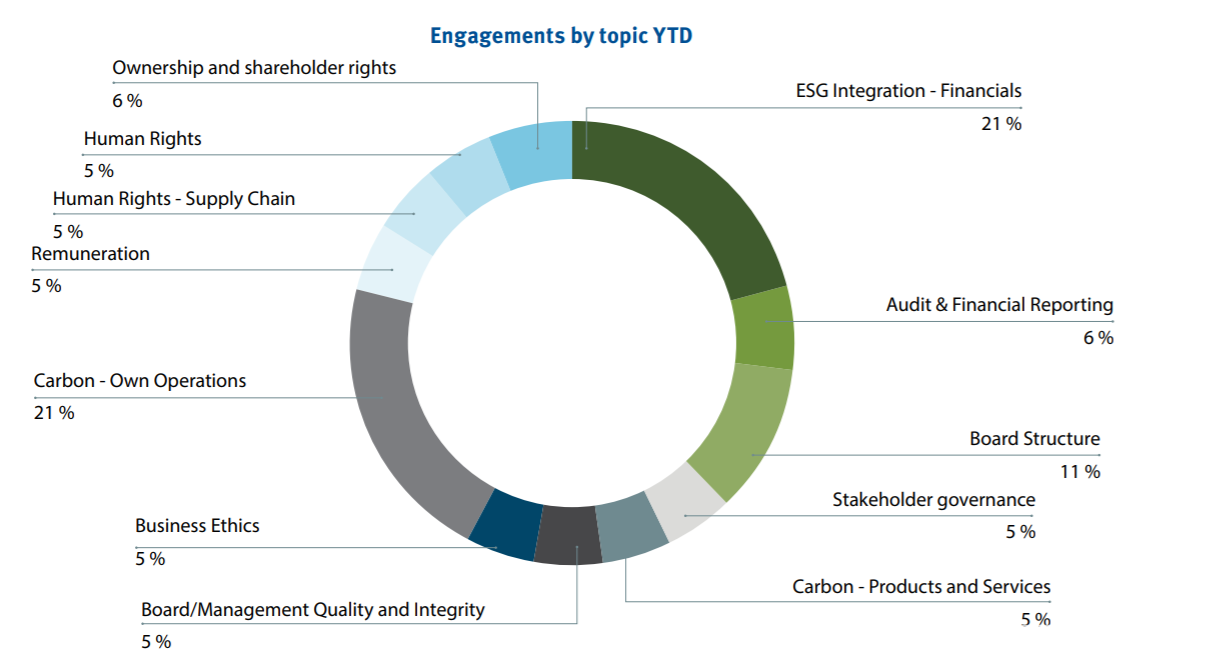

We initiated seven new engagement cases during the second quarter, bringing the number of current engagement dialogues to a total of 18 with 14 different companies.

During the quarter, there was a particular focus on governance-related ESG topics. Engaging on governance topics does not mean neglecting discussions of a more environmental or social nature, but rather improving the latter two parameters through improved governance.

By way of example, gender equality and the importance of having women on boards and at executive level are clearly social topics for investors, but ones which can be effectively improved through better governance. During the quarter, SKAGEN Kon-Tiki signalled its expectation to Gideon Richter and X5 Retail Group to improve their governance plan to increase the number of women on their respective boards.