The terrible war in Ukraine has been challenging for most investors, especially coming alongside rising inflation and interest rates. It has certainly provided a stern test for SKAGEN Vekst, with the exclusion of Russia from SKAGEN's investment universe seeing the fund's holdings in Sberbank, Gazprom and Segezha written down to zero until the Russian stock market reopens for foreign investors and the positions can be sold. The three companies represented almost 5% of the portfolio's value at the start of the year, yet despite this significant headwind, Vekst's strong performance has remained on track.

Active risk management

After facing a perfect storm in 2020 caused by the pandemic, events in Ukraine have offered another examination of Vekst's investment process and management of risk – a challenge it has successfully overcome. For active investors, selecting the right risks is key to delivering the best returns, as Vekst Portfolio Manager, Søren Milo Christensen, explains: "Rather than minimising it, my job is to recognise and manage risk to ensure that unitholders are well rewarded for the direct and indirect ones the fund takes on their behalf."

This is done bottom-up by looking at company-level factors such as profit margin, cost structure, debt and competitive position, as well as top-down by analysing portfolio-level exposures to macroeconomic, market and political factors.

"The focus with company-level risks is how they interact and looking at different scenarios. Financial risk is key and avoiding situations where a deterioration in company profits introduces balance sheet risk into the investment case." Christensen explains. "Valuation is also crucial for downside protection, particularly if there is a higher degree of uncertainty in the scenario analysis."

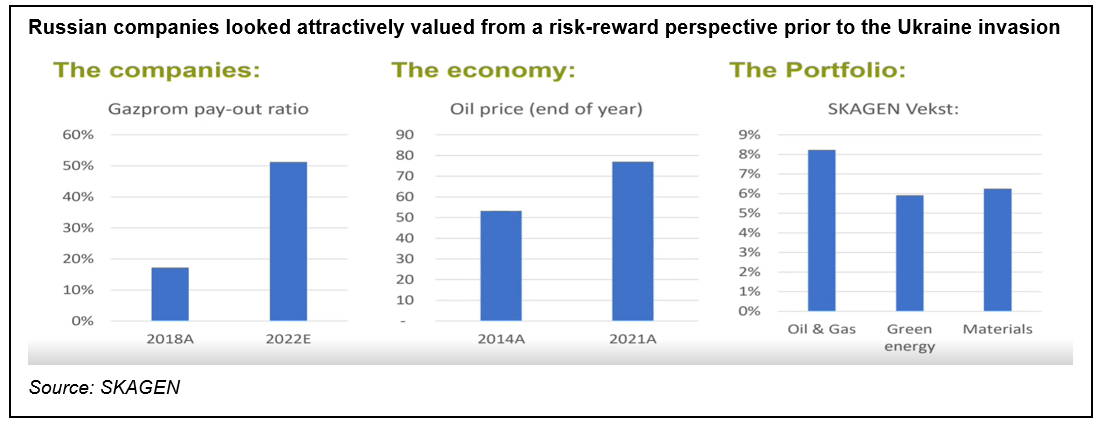

As well as being attractively valued, the Russian holdings selected for Vekst's portfolio had demonstrably improved their capital allocation over time. Gazprom, for example, has seen a steady rise in its pay-out ratio and was on track to distribute more than half its earnings in dividends this year. Aside from providing a very attractive return from dividends alone, it also led to a more efficient use of its retained earnings, resulting in a higher return on new investments.

Second-order effects are the focus of portfolio-level risks, for example how changing commodity prices might impact the economic, political or regulatory environment for different countries, as Christensen outlines: "The key is to know your portfolio companies very well and then closely monitor the top-down indirect threats they face."

With oil priced at around $75 a barrel at the start of the year, the Russian economy and its companies looked well-positioned to withstand any potential sanctions relative to its 2014 annexation of Crimea when oil was around a third cheaper. The Vekst portfolio also had exposure to stocks outside Russia that were likely to benefit from any escalation of the situation in Ukraine, such as companies involved in materials and energy.

Stocks from these two categories were the top four contributors during the first quarter, helping to counter the war's negative effects on overall portfolio performance and underlining its robust positioning against the second-order effects of Russia's invasion.

Stock selection driving strong returns

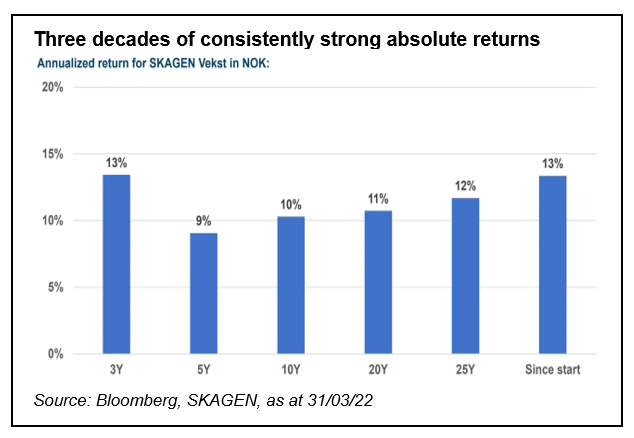

Vekst will celebrate its 30th anniversary next year and its objective to provide the best possible absolute returns for clients remains the same. The fund's impressive average annual return of 13% since launch in 1993 has been maintained during the most recent 3-year period which includes the war in Ukraine (and COVID). This success has been driven by good stock selection. Picking the right companies – and risks – from all regions outside Russia means that Vekst has also performed strongly relative to the fund's benchmark which it has beaten by more than 2% both year-to-date and over the last 12 months.

Looking ahead Christensen believes that the international response to events in Ukraine from governments, companies and investors could have consequences far beyond the region, for example how the West deals with China: "While Ukraine was a 'black swan' event it is likely to accelerate questions about where companies source raw materials and locate factories, which could reverse globalisation and have implications for long-term economic growth and inflation."

More immediately Vekst looks well-placed to navigate rising prices and interest rates through its holdings in financial and energy-related companies that tend to do well in such an environment. The portfolio also has attractive exposure to several emerging markets stocks trading at highly discounted valuations.

By applying its enduring active, value-focused philosophy and a robust investment process, the fund's unitholders can be reassured that the best possible risk-adjusted returns should continue to follow.

NB: All figures in NOK as at 31/03/22 unless stated