The content on this page is marketing communication

Fundamental investing in an uncertain world

Since the beginning of summer a series of political and terrorist-related shocks have created waves of economic and market uncertainty across the globe.

In June, the UK's decision to leave the EU jolted equity and currency markets far beyond Europe and just as investors began to visualise what form Brexit might take, a number of terrorist attacks across the continent and a failed military coup in Turkey have created further unease in an already uncertain world.

This recent period of tension provides a timely reminder of how our portfolio managers seek to maximise client returns and mitigate risks. At a time when information flows quicker than ever and financial markets have become increasingly interconnected, our investment philosophy and objective remains unchanged; we select attractive companies which offer more than adequate compensation in valuation terms for the risk taken from investing in them. This weighing of company fundamentals against macro risks and valuation is at the core of every investment we make.

Erik Landgraff, SKAGEN Kon-Tiki Portfolio Manager, explains: "While successful value investing requires healthy scepticism, it also involves making informed decisions based on experience rather than blind contrarianism. History has taught us that markets tend to overreact to both good news and bad, which presents opportunities. It has also demonstrated that the link between country-level macro developments and long-term stock prices is rather unpredictable, while starting valuations have much greater predictive power."

Keeping perspective

It is also important to retain a sense of perspective when investing, particularly during periods of perceived turmoil. Markets typically react negatively to uncertainty but while recent global events have caused political instability and some economic ambiguity, their impact on equity markets appears to be more limited. The MSCI All Country World index and S&P 500 both quickly recovered their steep losses following the initial shock of the UK referendum, while the FTSE 100 is currently at a 12-month high suggesting that despite the potential economic uncertainty surrounding Brexit, investors see limited long-term impact on equities.

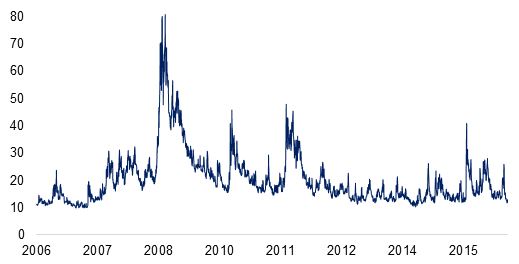

Meanwhile the VIX index, which is a closely-watched proxy for stock volatility sometimes known as the 'fear gauge', shows that although recent levels have been elevated compared to the benign conditions of 2012-2014, they are well down on last summer when panic set in that a Chinese stock market meltdown and economic slowdown would spread to the global economy, and are currently six times below their peak during the 2008 financial crisis (see chart).

Equity market volatility well below historic highs

Source: VIX index 2006 - 2016

The potential risks that could prevent a company from realising its upside potential inevitably come into sharper focus however when macro uncertainty increases. Knut Gezelius, Lead Portfolio Manager of the equity fund SKAGEN Global, explains: "Our analysis is always bottom-up with risk assessment carried out at the company level in terms of the economic, political and social context in which it operates. An increase in risk requires a higher expected return, or risk premium, to compensate us for investing. Fortunately we have a global mandate and a large pool of ideas; we make assessments every day about the merits of our portfolio holdings relative to alternative investments."

Referendum conundrum

The economic and political implications of the UK's decision to exit the EU are still unclear a month after the referendum and are likely to remain so for some time as Brexit negotiations play out. In the short-term markets are often driven by sentiment rather than fundamentals while in the long-run factors such as earnings growth and return on capital have a much greater influence on share price performance. Gezelius explains: "In an increasingly complex world it is impossible to predict with great accuracy the ramifications of something like Brexit or how investors will react to it. Instead we focus on finding structurally well positioned companies at attractive valuations; buying on weakness and selling on strength to generate long-term value for our investors."

The Global fund used the uncertainty around the UK referendum to increase several of its holdings with solid fundamentals which were disproportionally impacted by the market sell-off, including AIG, Citigroup and Kingfisher. The latter is one of four UK-listed companies which make up 7.1% of the portfolio. Most of these operate globally so the risk to the fund from a UK economic slowdown is limited and some, such as Hiscox, are benefitting from sterling weakness following the vote.

While the short-term geopolitical picture in Europe is likely to remain uncertain during Brexit, elevated volatility should present further opportunities. Europe and the US experiencing an extended period of low interest rates could also have a positive impact on emerging markets and provide opportunities for investors. The Kon-Tiki fund has minimal UK exposure with less than 1.8% of the portfolio invested in Tullow Oil, a multinational exploration company, and two UK-listed Vietnam-focused funds, Vina Capital and Vietnam Enterprise Investments.

Turkish turmoil

While the UK referendum result surprised many, a far less predictable political event occurred several weeks later when the Turkish army attempted to overthrow the Erdoğan government. Although a military coup is by definition sudden, it was perhaps not a total surprise given that the rapid economic growth Turkey has experienced under the ruling AK Party has come at the cost of basic liberal freedoms and increasing political polarisation.

SKAGEN Global has no Turkish holdings and although SKAGEN Kon-Tiki has 7.2% of its portfolio invested there, the team is comfortable with its exposure, as Erik Landgraff explains: "We have kept a close eye on Turkey's political developments over the past few years and avoided companies we consider to be vulnerable to this type of event, which is likely to cement the regime's grip on power. We currently still see good opportunities for our Turkish holdings but would change our view if the risk-reward outlook significantly deteriorates."

SKAGEN Kon-Tiki has no direct ownership of companies in the banking or tourism sectors which are likely to feel the biggest impact from negative sentiment and deteriorating fundamentals. At 4.3% of the portfolio, the majority of its Turkish exposure is through Sabanci Holding, a conglomerate which is well-diversified across consumer, industrial, financial and energy sectors, and has previously shown its resilience by delivering strong earnings during the financial crisis. To illustrate the importance of taking risks that are adequately rewarded, despite a tougher July, Sabanci has been a positive contributor to absolute return, year-to-date, and was one of the fund's best performers last year despite a weak Turkish market.

Recent events also highlight how both developed and emerging markets can be impacted by shocks, albeit often in different ways. They also underline the benefits of having a broad, unconstrained mandate to find the best opportunities and avoid unrewarded risks. For all countries where we have holdings or company exposure, we will continue to monitor the political situation, question our assumptions and attempt to separate valuation signals from market noise to best understand the dynamics of risk and reward. Provided that company valuations are sufficiently attractive to compensate the funds for incurring the risks that they face, our investors should continue to be rewarded.