The content on this page is marketing communication

Performance Update Q4 2018

The last quarter of 2018 proved to be a challenging period for many investors and equity market volatility shot up to extreme levels towards year-end.

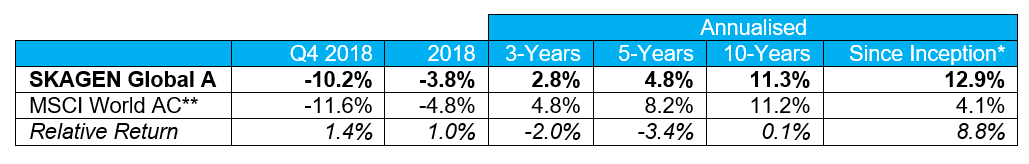

SKAGEN Global

Solid relative performance as global equities suffer their largest annual losses for a decade. SKAGEN Global A fell 10.2% in the quarter, outperforming the MSCI All Country World Index which dropped 11.6%.

Figures as at 31 December 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 07/08/1997

** Before 01/01/2010 benchmark was MSCI World Index

-

Intercontinental Exchange (ICE) was the largest contributor as the US exchange operator’s recurring revenues helped to shield it from concerns over a slowdown in global growth. Unilever was the next best performer with the Anglo-Dutch consumer goods giant also insulated from economic worries by its defensive product mix and geographic diversification.

-

UPM was the biggest detractor as sentiment towards the Finnish paper and forestry company was impacted by lower pulp prices. Danish freight company DSV was the next weakest performer, hurt by concerns over a potential trade war and weaker European economic data.

-

Two new companies entered the fund; Hannover Re (we like the German reinsurer’s disciplined underwriting, low-cost culture and long-term focus) and Waste Management (we believe a combination of market consolidation, capital allocation discipline and free cash flow generation makes the US integrated environmental solutions provider an attractive investment opportunity).

-

Two companies left the portfolio; IRSA (the Argentinian real estate conglomerate appears vulnerable to higher domestic inflation that it may not be able to offset with rent increases) and Novo Nordisk (we expect the Danish pharmaceutical company to face greater price competition and regulatory pressure).

Quarterly Report: Read the SKAGEN Global Q4 2018 Report here (pdf)

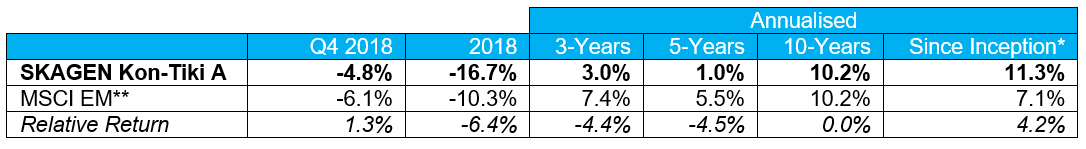

SKAGEN Kon-Tiki

Brazilian holdings’ strength drives relative fund gains as EM outperform DM. SKAGEN Kon-Tiki A dipped 4.8% during the quarter, outperforming the MSCI Emerging Markets Index which lost 6.1%.

Figures as at 31 December 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 05/04/2002

** MSCI EM Index (net total return) did not exist at the inception of the fund and consequently the benchmark index prior to 01/01/2004 was the MSCI World AC Index. This is not reflected in the table above which shows the MSCI EM Index since the fund’s inception

-

Banrisul was the best performer, boosted by the election of new populist Brazilian president and rumours that the bank could be a beneficiary of his privatisation plans. Compatriot Cosan was the second largest contributor, lifted by a rising domestic equity market and positive signs from the ethanol producer’s corporate restructuring.

-

Borr Drilling was the fund’s largest detractor followed by Golar LNG, with both companies hurt by a falling oil price which negatively impacted the wider energy sector.

-

Four companies joined the fund; former holding Lundin Mining and Turquoise Hill (we expect both companies to be boosted by rising copper demand), Wuliangye Yibin (a Chinese liquor producer we anticipate will benefit from a customer shift towards domestic brands) and Suzano (a Brazilian pulp producer we also held previously that should benefit from lower input costs and easing price pressure).

-

We exited from long-term holding Anadolu Grubu as we currently see better opportunities outside of Turkey.

Quarterly Report: Read the SKAGEN Kon-Tiki Q4 2018 Report here (pdf)

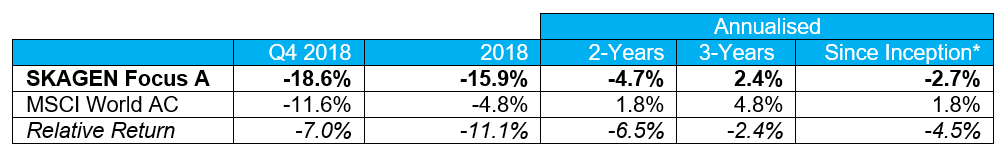

SKAGEN Focus

Absolute and relative weakness as market volatility creates attractive buying opportunities. SKAGEN Focus A dropped 18.6% over the quarter, lagging the MSCI All Country World Index which lost 11.6%.

Figures as at 31 December 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 26/05/2015

-

Gold Fields was the top performer with the South African miner boosted by rising gold prices amid falling investor risk appetite. Sao Martinho was the next best performer, lifted by a strong Brazilian equity market (see above).

-

SoftBank was the largest detractor as market volatility created uncertainty around the flotation of the Japanese conglomerate’s mobile business. AIG was the next weakest performer as the US insurer delivered another set of disappointing results impacted by major catastrophes.

-

We took advantage of market volatility to add three new companies; JAPEX (a Japanese oil and natural gas exploration company which owns an attractive stake in sister company INPEX), NLB Group (a Slovenian bank which carried out a deeply discounted IPO and has an attractive dividend yield) and OZ Minerals (an Australian copper and gold miner with high quality assets and a strong balance sheet).

Quarterly Report: Read the SKAGEN Focus Q4 2018 Report here (pdf)

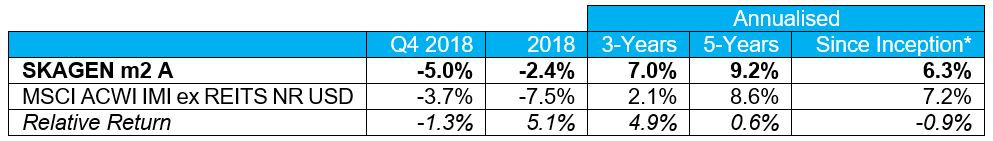

SKAGEN m2

Absolute and relative weakness as real estate sector impacted by equity market turmoil. SKAGEN m2 A dropped 5.0% during the quarter, underperforming its benchmark index which fell 3.7%.

Figures as at 31 December 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 31/10/2012

- Swedish logistics operator Catena was the top performer, boosted by strong growth in e-commerce and a domestic real estate market buoyed by attractive valuations. Brazilian residential developer MRV was the next largest contributor, lifted by impressive results and a strong domestic property market.

- Hembla (previously named D. Carnegie) was the weakest performer as the Swedish company retreated after delivering impressive gains earlier in the year. Columbia Property Trust was the next largest drag on performance, despite the US real estate company delivering strong results and rumours of a potential takeover.

- Two new holdings entered the portfolio; Shurgard (Europe’s largest self-storage company has attractive cash flow generation and a resilient earnings profile) and Stendörren Fastigheter (an undervalued Swedish company which manages and develops warehouses and industrial premises).

Quarterly Report: Read the SKAGEN m2 Q4 2018 Report here (pdf)

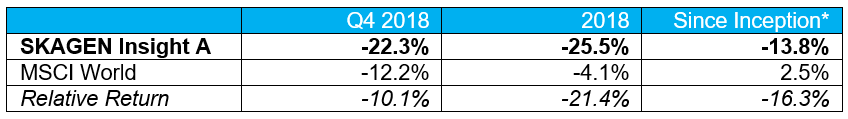

SKAGEN Insight

Absolute and relative weakness as activists faced continued headwinds amid elevated market uncertainty. SKAGEN Insight A declined 22.3% during the quarter, underperforming the MSCI World Index which was down 12.2%.

Figures as at 31 December 2018 in EUR and net of fees

* Inception date: 21/08/2017

-

Stock Spirits was the top performer as the alcoholic drinks producer was boosted by unexpectedly strong results, followed by US confectionary company Mondelez International.

-

German engineering company Thyssenkrupp was the largest detractor, followed by US-based Armstrong Flooring; both are high conviction positions and we have been encouraged by recent developments at both companies where we expect activists to play a decisive role in creating significant shareholder value.

-

The portfolio remains attractively valued and we believe it has the potential to more than double over the next 2-3 years as markets stabilise and activists increasingly become the catalyst for positive change.

Quarterly Report: Read the SKAGEN Insight Q4 2018 Report here (pdf)

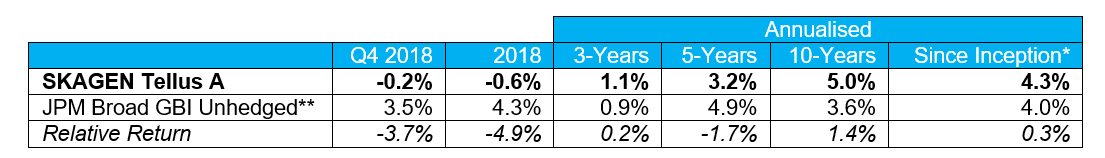

SKAGEN Tellus

Mexican and Norwegian headwinds drive absolute and relative weakness. SKAGEN Tellus A fell 0.2% in the quarter, underperforming the JPM Broad GBI Unhedged index which climbed 3.5%.

Figures as at 31 December 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date 26/05/201529/09/2006

** Before 01/01/2013 benchmark was Barclay's Capital Global Treasury Index 3-5 years

-

Our Indian bond was the best performer, boosted by a falling oil price which is positive for the Indian economy, budget balance and current account deficit. Our US holding was the next largest contributor, lifted by the dollar appreciating against the euro.

-

Mexico provided our weakest investment as interest rates increased sharply following the new president’s decision to halt construction of a new airport. Our Norwegian holding was the next largest detractor, hurt by a weaker krone as a result of falling oil prices, low liquidity and risk-off sentiment towards the end of the year.

-

The fund increased its holdings of short-dated US treasuries during the quarter.

Quarterly Report: Read the SKAGEN Tellus Q4 2018 Report here (pdf)

_______________________________________________________

All contribution figures are based on NOK returns at the fund level.

Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on market developments, the fund manager’s skill, the fund’s risk profile and subscription and management fees. The return may become negative as a result of negative price developments.

This message is only intended for the recipient and may contain confidential or other private information.