The content on this page is marketing communication

Performance Update Q3 2017

SKAGEN Performance Update – A tough third quarter

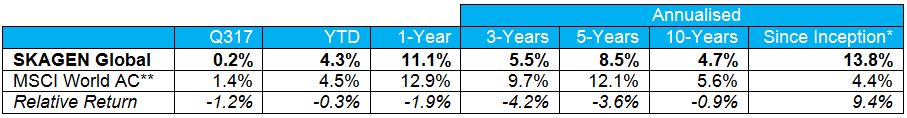

SKAGEN Global A

Global equities pause for breath as economic outlook remains healthy; portfolio upside increases to 25%. SKAGEN Global climbed 0.2% during the quarter, underperforming the MSCI All Country World Index which added 1.4%.

Figures as at 30 September 2017 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 07/08/1997

** Before 01/01/2010 benchmark was MSCI World Index

- NN Group was the top contributor with the Dutch insurer boosted by growing confidence in its ability to extract cost synergies from the Delta Lloyd acquisition and a favourable court ruling over historic policy disclosure of investment risk. Baidu was the next best performer as China's largest search engine operator delivered strong results with impressive growth in revenue and profits.

- Medtronic was the largest detractor with the medical device supplier hurt by its diabetes division reporting results below expectations and investor aversion to defensive sectors. G4S was the next worst performer as the UK-based security company delivered disappointing results with slowing revenue growth.

- Five new holdings entered the portfolio. Following the addition of Deutsche Wohnen, Waters Corporation, Chubb and Beazley earlier in the quarter, Schindler, the Swiss elevator company with a growing Asian presence and a strong balance sheet, was added in September.

- Seven companies departed the fund. Following the exits of AIG, Johnson Control, Sanofi, State Bank of India and General Electric earlier in the quarter, Kingfisher exited in September as slower than expected execution in a continued tough retail environment has reduced our conviction in the home improvement company, while Akzo Nobel was sold after strong share price performance.

- The portfolio remains attractively valued with average upside of 25% for the top 35 holdings*.

Quarterly Report: Read the SKAGEN Global Q317 Report

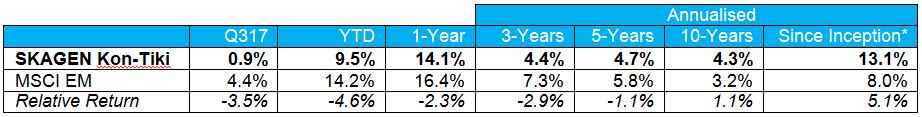

SKAGEN Kon-Tiki

Underweight exposure to a strong Chinese market impacts relative returns as emerging market outperformance continues. SKAGEN Kon-Tiki increased by 0.9% in the quarter, underperforming the MSCI Emerging Markets Index, which was up 4.4%.

Figures as at 30 September 2017 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 05/04/2002

- X5 Retail Group was the largest contributor as the Russian grocer continues to beat expectations with impressive top-line growth and margin expansion from operating leverage. Brazilian bank Banrisul was the next best performer, boosted by privatisation rumours, strong operational performance and a buoyant domestic equity market.

- Hyundai Motor was the largest detractor as the auto manufacturer delivered disappointing results with weak US demand and sales disruption in China from anti-Korea campaigns. Turkish conglomerate Sabanci was the second worst performer following a share sale by one its founding family members.

- Gree Electric entered the portfolio and became our first investment in Chinese A-shares. The world's largest air conditioning manufacturer is attractively valued and enjoys a strong position in a growth market.

- Three companies exited the fund. Aberdeen Asset Management departed following strong share price performance linked to its merger with Standard Life, Bharti Airtel was sold after delivering similar gains and we sold Norwegian shipping company Solstad Farstad to continue our portfolio streamlining.

- The portfolio remains attractively valued with average upside of 30% for the top 35 holdings*.

Quarterly Report: Read the SKAGEN Kon-Tiki Q317 Report

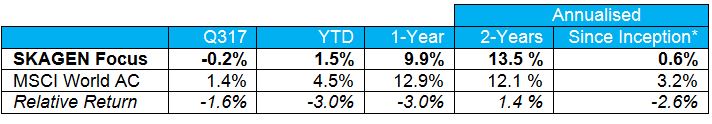

SKAGEN Focus

New holdings performing well as global equities remain resilient; attractive 48% portfolio upside. SKAGEN Focus fell 0.2% in the quarter, underperforming the MSCI All Country World Index which climbed 1.4%.

Figures as at 30 September 2017 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 26/05/2015

- Stock Spirits was the largest contributor with the Eastern European beverage producer reporting strong results and market share stability in Poland. JBS was the next best performer as the Brazilian food producer delivered solid financial performance, boosted by expanding beef margins.

- Teva was the largest detractor with the indebted Israeli pharma company delivering disappointing results but positively announcing a new CEO and the disposal of non-core assets to strengthen its balance sheet. Fila Korea was the next worst performer as its US direct segment has been performing poorly, in line with peers in a tough retail environment.

- Brighthouse Financial entered the portfolio during the quarter as we believe the independent US life insurer with a sizeable annuities business has an attractive valuation and the potential to payout a generous dividend.

- We exited from three companies with Peugeot owner FFP in addition to Fourlis and E-Mart all sold after strong share price performance.

- The portfolio remains attractively valued with an average upside of 48% for the top 10 holdings*.

Quarterly Report: Read the SKAGEN Focus Q317 Report

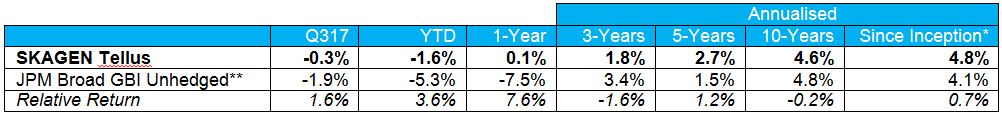

SKAGEN Tellus

Dollar weakness blunts absolute performance but USD and JPY underweight drives relative strength. SKAGEN Tellus dipped 0.3% over the quarter, outperforming the JPM Broad GBI Unhedged index which lost 1.9%.

Figures as at 30 September 2017 in EUR, net of fees and annualised for periods greater than one year

* Inception date 26/05/2015

** Before 01/01/2013 benchmark was Barclay's Capital Global Treasury Index 3-5 years

- The fund's Portuguese bond was the largest contributor, boosted by S&P upgrading Portugal to investment grade following strong economic growth and responsible fiscal policy.

- The fund's relative outperformance was due to its underweight USD and JPY exposure, both of which depreciated by c.3.5% against the EUR.

- The portfolio duration is currently 4.5 years, which is substantially below the index (7.8 years). Tellus only takes interest rate risk in countries where there continues to be a compelling case for a fall in the interest rate and / or the yield is very attractive.

- A Uruguayan bond entered the portfolio as we find the long-term yields to be very attractive given the country's credit strength. Growth in Uruguay has been resilient and the authorities appear committed to delivering sustainable public finances. We added to our Dominican Republic position by buying a USD-denominated bond. We also increased the duration of our Indian holding by buying a bond issued by the Asian Development Bank as we expect to see lower inflation expectations and long-term yields.

- We reduced our Croatian bond holding following strong performance as we anticipate increased country risk from the financial problems at Croatia's largest company, Agrokor.

Quarterly Report: Read the SKAGEN Tellus Q317 Report

----------

* Potential upside based on internal price targets over a two-year investment horizon.

All contribution figures are based on NOK returns at the fund level.

Important information

Except otherwise stated, the source of all information is SKAGEN AS as at the date of the publication of the investment report. Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on market developments, the fund manager's skills, the fund's risk profile and subscription and management fees. The return may become negative as a result of negative price developments. Statements reflect the portfolio managers' viewpoint at a given time, and this viewpoint may be changed without notice. This report should not be perceived as an offer or recommendation to buy or sell financial instruments. SKAGEN AS does not assume responsibility for direct or indirect loss or expenses incurred through use or understanding of the report. Employees of SKAGEN AS may be owners of securities issued by companies that are either referred to in this report or are part of the fund's portfolio. SKAGEN AS does not give advice to Dutch retail investors. We always recommend that you speak to your financial adviser before making any investment decisions. They can take into account your personal circumstances when discussing financial objectives and how best to achieve them. Before you invest, you should consider and understand the risks of investing in the funds. Further information on the funds and the risks associated with investing can be found in the Full Prospectus or the Key Investor Information Document(s). These documents are available in English and you can request copies by contacting our offices.