- Global equities stabilised with the MSCI All Country World Index ending the week 1.0% lower to close the first quarter down around 20%.

- Economic data generally painted a gloomy picture across the globe with PMI figures well down and pointing to a severe recession while unemployment numbers came in worse than expected in many countries, including the US.

- Better news came from China where official PMI numbers pointed to economic expansion as the country emerged from lock down and the possibility of a faster than anticipated recovery. Markets were further boosted by a rising oil price on news that Saudi Arabia and Russia may reach a deal to cut oil supply and drive up prices further in the face of dwindling global demand.

Here are selected events relevant for our funds:

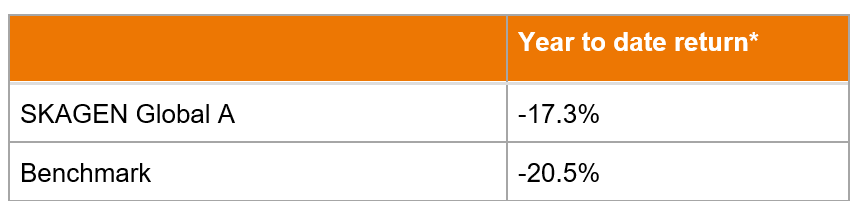

SKAGEN Global

- The portfolio managers remain focused on conducting bottom-up fundamental research on existing and prospective positions to selectively capitalise on excess volatility and improve the long-term outlook for the portfolio.

- The fund didn't enter or exit any positions last week but made minor portfolio adjustments in response to extreme share price movements.

- The fund retains a liquid portfolio with a cash position below 1% in order to remain invested in the market.

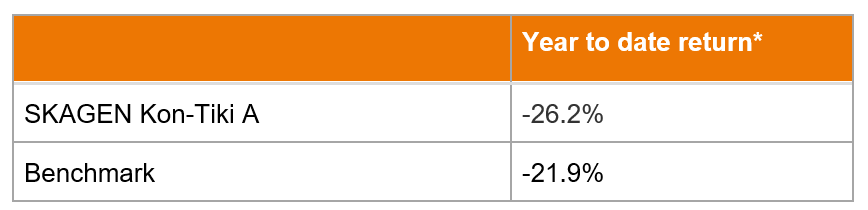

SKAGEN Kon-Tiki

- SKAGEN Kon-Tiki outperformed the index over the week as the portfolio managers continued to focus on protecting the integrity of the portfolio from external stress.

- They followed up in detail on key holdings with a number reporting decent 2019 results, while also engaging with other existing and potential holdings.

- There was no major trading activity during the week as market volatility subsided slightly, with the main portfolio moves in line with previous weeks; reducing lower conviction positions and taking advantage of intra-week volatility, especially in the energy segment. They also continued to add cautiously to some hot-pot positions. The fund's cash position is 6%.

SKAGEN m2

- The real estate sector rebounded at the end of the quarter, driven by the most defensive market segments. Companies driven by secular trends or those with strong balance sheets also emerged as the relative winners.

- The investment team continue to focus on companies they consider to be resilient in trend-driven sub-segments and with good cash flow generation and balance sheet structure.

- The portfolio remains liquid and the fund's cash position is currently 7.4%.

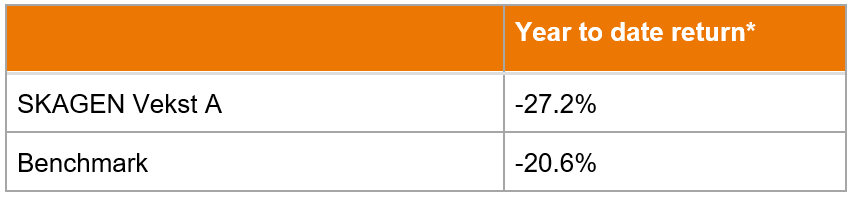

SKAGEN Vekst

- Last week brought renewed optimism for the oil price with a potential agreement to cut production between OPEC+ and the US, although uncertainty remains.

- There was no significant trading activity during the week.

- The overall portfolio remains highly liquid with a current cash position of 3.6%.

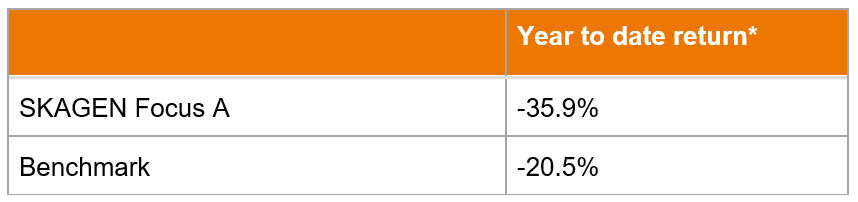

SKAGEN Focus

- The fund currently has a record low allocation towards US assets at around 12% of assets, reflecting the portfolio managers' belief that the US economy is heading for an extremely difficult period as the country faces an unprecedented shutdown to limit the effects of Covid-19.

- They also expect that a large part of the "quality/growth" complex, which still trades at exceptional multiples, will finally be exposed as being more cyclical than previously thought and they anticipate shrinking valuation multiples. This development could be further propelled by substantial outflows from index and ETF-related vehicles as retail investors finally capitulate, primarily in the US.

- The portfolio managers believe that Korean and Japanese equities have superior financial positions and should eventually produce substantial outperformance, which is reflected in 40% of the fund's assets being invested in undervalued Chinese, Japanese and Korean companies with strong balance sheets.

- The fund's cash position is 6.5%.

Fixed Income Funds

- The Norwegian Kroner continued to strengthen last week while it was a quieter week in government bond markets with less volatility than previous weeks. Emerging market credit spreads remain high but seem to have stabilised and have even narrowed in some countries.

- Norwegian credit market liquidity continues to improve, including in the money market. The secondary market is also functioning well with high liquidity at all maturities. Norwegian banks are solid (due to stricter regulation following the GFC) so there are no concerns over the financial strength of the sector. The portfolio manager expects credit spreads for bank paper to fall going forward.

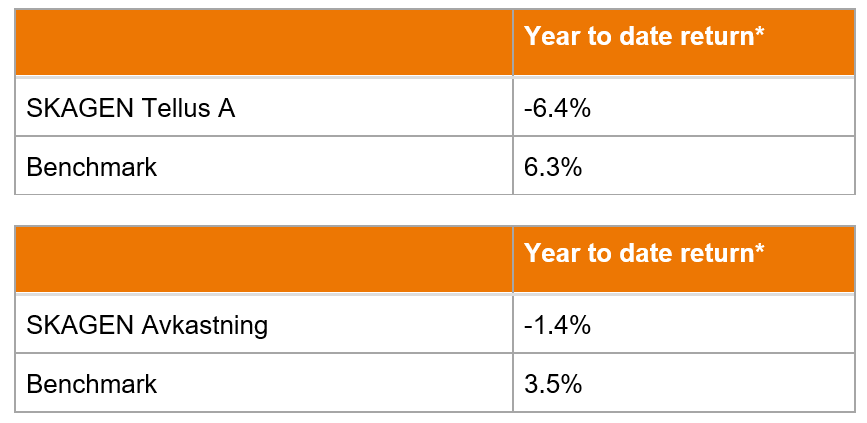

- The funds' cash positions are currently 7.5% (SKAGEN Tellus) and 3.6% (SKAGEN Avkastning).

* All figures in EUR as of 3 April 2020