If I offered you ten dollars to roll a six in a game of dice or USD 10 million to avoid the bullet in a game of Russian roulette – which would you choose? The dice game of course! Because even though the winnings are vastly greater in Russian roulette, the stakes are also immense - you risk paying with your life.

Making the right choice is about knowledge and experience. If you were unfamiliar with the rules of Russian roulette and just saw the first five people pull the trigger and walk away with 10 million dollars each, while the corresponding number of winners in the dice game left the table with a paltry 10 dollars each, you would clearly opt for the chance to win ten million dollars.

It is all about context, however, and if you are familiar with the game and know how probability works, you would be very unlikely to choose Russian roulette – regardless of the potential winnings. Throwing dice and Russian roulette have different outcomes depending on what has happened before. Dice is a game of luck – the probability remains the same, regardless of what has happened before – but in Russian roulette the odds change depending on how many chambers are left.

Stretched valuations

The current situation with valuations is similar.

The valuation of large tech stocks, in particular, has risen to incredible heights over the past decade. And because the market is more expensive than ever, the returns you can expect in future are likely to be lower as well. At least if we as value investors take as a starting point that investment is about exploiting the gap between price and value that is driven by investor behaviour. The price is now so high that it is hard to imagine that there are more good balls – or "fat pitches" – still in play. In which case it might be wiser to sit out the game.

When it comes to value versus growth, I don't know which chamber we are on, what I do know is that:

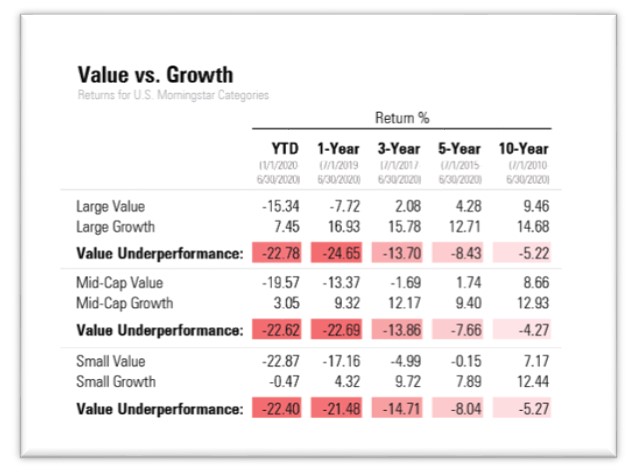

- Growth stocks - the polar opposite of value investing - have had momentum for a very long time, so the probability of this strategy continuing to provide satisfactory excess returns is decreasing rapidly.

- People make mistakes - even at the worst times - and if share prices are pushed too far in one direction - as was the case 20 years ago before the .com crash – then they will rebound far in the opposite direction before correcting and finding equilibrium.

The sixth player

At around the turn of the millennium, star investor and philanthropist Stanley Druckenmiller was the figurative sixth player in a game of Russian roulette.

In early 2000, he sold all of his tech stocks with near-perfect timing (at 104x earnings). He sensed it was time to step out of IT stocks and wait for the next "fat pitch". But throughout the spring, he watched colleagues continuing to earn three percent a day on their tech stocks, which continued to rise. Even though everything in him warned against it, he still ended up letting the fear of missing a good trade prevail and bought tech stocks for six billion dollars just as the market peaked and the dotcom bubble burst. He lost three billion dollars. But as he later concluded in a famous speech in 2015 (since reproduced in the book Big Mistakes: The Best Investors and Their Worst Investments by Michael Batnick): "You asked me what I learned. I didn’t learn anything. I already knew that I wasn't supposed to do that [invest in tech stocks at the time]. I was just an emotional basket case and couldn't help myself. So, maybe I learned not to do it again, but I already knew that."

When you give up on fundamentals and see other people making money, then the fear of missing out, the fear of losing the reputation that you've built over time and the fear of losing your job drive you to make mistakes.

Russian roulette is the complete opposite of waiting for a good ball - a "fat pitch". Both in baseball and on the stock market, there is talk of waiting for "the fat pitch". In baseball, you have three chances - three balls - and thus a psychological tendency to strike too early for fear of running out of attempts instead of waiting patiently for the good ball - the "fat pitch". When you invest, you have endless chances, yet there are numerous examples of experienced investors who - even though everything in them warns that they should not - jump on a stock seconds before a crash. Druckenmiller is just one example.

It is when I go against my own fundamental philosophy and beliefs that the risk of making mistakes increases most markedly. Sometimes you get lucky when you do the wrong thing and sometimes you get unlucky when you do the right thing. But over time, I have no doubt that what our clients are paying for us is to do the right thing – deep down they know it's really hard and we need to keep that in mind.